The development of the Basel Accords continues to evolve. As a result, from 2012-2017, the commission dealt with questions about the obligations of banks to central counterparties, collateral requirements, measurement of counterparty credit risk, and calculation of securities capital requirements. They did this by introducing the Fundamental Review of the Trading Book (FRTB) capital requirements and improving the disclosure framework.

What Changed from Basel I to IV?

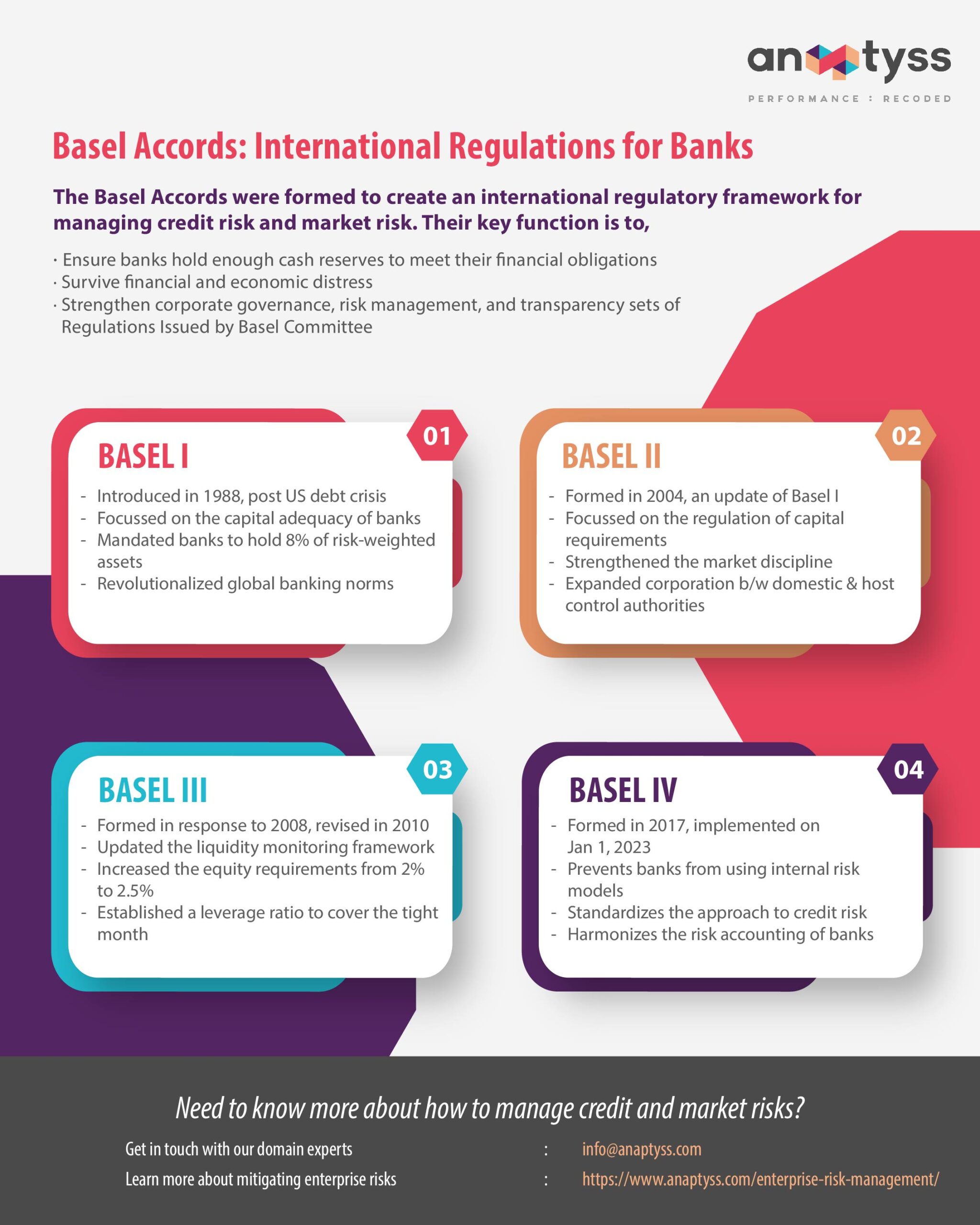

Basel I, II, III, and IV are the international banking accords issued by the Basel Committee on Banking Supervision (BCBS) for the banking sector to improve the quality of banking supervision and strengthen the international banking system worldwide.

Below we have discussed the evolution of the Basel Accords from Basel I to Basel IV highlighting the importance and reforms integrated into the Basel framework—a full set of standards of the Basel Committee on BCBS.

Basel Accords I: Basel Capital Accords

Basel I was created in the 1980s in response to the US debt crisis. The debt crisis has shown concern about the solvency relationships of international banks. The G10 supported the introduction of capital requirements and adequacy measures. As a result, updated banking requirements were sent to banks in July 1988.

The salient features of Basel I are as follows.

- Basel-I required banks to hold at least 8% of risk-weighted claims.

- The framework was introduced in all countries, not only the Member States.

- The Agreement was amended in 1998 to include general bad debt provisions. The draft contract included credit risks and financial risks.

Basel Accord II: The New Capital Framework

The second Basel Accord was established in 2004. But it was preceded by constant efforts. In June 1999, the Commission proposed a new solvency framework to replace the 1988 agreement.

The salient features of Basel II are as follows.

- The Treaty extended the rules established in the Treaty of 1998 (added details and details).

- The new agreement revised the internal valuation process and used disclosure to strengthen market discipline.

- As a result, it raised quality banking practices. The second agreement focused on the regulation of capital requirements.

- It expanded cooperation between domestic and host control authorities.

Basel III: Response to the financial crisis of 2008

Basel III was only a response to the financial crisis of 2008. However, the banking system showed loopholes even before the collapse of Lehman Brothers (September 2008).

The banking sector had liquidity problems; it was simply bad management and a flawed incentive structure. The housing market collapse was simply the result of fundamental inefficiencies. The Basel decisions are constantly evolving, but banking systems will only stabilize if the guidelines are followed.

In September 2010, the Basel Committee presented another agreement on comprehensive capital planning and liquidity reforms. That agreement was called Basel III. Basel III was revised in December 2010.

The salient features of Basel III are as follows.

- Basel III updated the liquidity monitoring framework.

- It supported increasing the flexibility of banking systems. It focused on the quality and quantity of share capital.

- It increased equity requirements from 2 percent to .5 percent and added a 2.5 percent buffer. Here, common equity refers to the percentage of risk-weighted assets of banks.

- The agreement also established a leverage ratio that could cover the tight month (30 days)

Basel Accords IV: Completion of the Basel 3 reform package

In 2017, the Basel Committee agreed on changes to global capital requirements as part of the completion of Basel III. The changes are so far-reaching that they are increasingly seen as an entirely new framework, often referred to as Basel IV, also known as Basel 3.1, which will take effect under transitional rules from 2025.

Basel IV aims to level the playing field and harmonize the risk accounting of banks, not to increase the capital levels of banks around the world. However, the reforms are likely to have different effects across regions due to regional differences in the use of banks’ internal risk calculation models.

The salient features of Basel IV are as follows.

- Basel IV prevents banks from using internal risk models to assess the credit risk of large companies with a turnover of at least EUR 500 million.

- It also limits banks’ use of internal models across the lowest production level and changes the leverage, credit value adjustment (CVA), and operational risk frameworks.

- The purpose of the reforms is to harmonize the method of calculating the credit risk of banks when determining their capital requirements.

- The effect is greater in Europe and the Nordic countries, where banks are generally more users of internal risk models. For example, the European banking system needs about 19% more Tier 1 capital in its capital buffer, while Swedish banks need 28%. This is comparable to the rated Tier 2 capital of US banks.

You may also read Basel Accords: Purpose and History to learn more about the Basel Accords.

Basel Compliance with Domain-Centric Approach

Basel Compliance is important for banks and financial institutions to protect themselves from financial and operational risks. To comply with the Basel Accords recommendations and draft effective control frameworks and internal policies, you must have a thorough understanding of the banking domain and applicable regulatory mandates.

Furthermore, digital technologies play an important role in assisting and augmenting manual efforts. A domain-centric approach combined with digital solutions can provide the best strategy.

As a strategic partner, Anaptyss leverages its exclusive Digital Knowledge Operations™ framework and deep-domain expertise to help banks meet the Basel standards and compliance.

Want to learn more about Basel Accords and compliance strategies?

Write to us: info@anaptyss.com.

Tasneem Abdulrahman

Manager - AML Compliance

Leave a Reply

Your email address will not be published. Required fields are marked *