In an era where digital assets are reshaping financial landscapes, compliance professionals face unprecedented challenges in detecting and preventing illicit activities. As cryptocurrency adoption accelerates, so does the sophistication of financial criminals seeking to exploit regulatory gaps and technological vulnerabilities.

Cryptocurrencies have revolutionized finance through decentralization, borderless transactions, and innovative financial products. However, these same features create significant anti-money laundering (AML) challenges. According to recent industry reports, cryptocurrency-related money laundering reached an estimated $22 billion in 2023, highlighting the urgent need for robust compliance solutions. Furthermore, the U.S. Federal Bureau of Investigation (FBI) reported that cryptocurrency-related investment fraud losses totaled over $5.6 billion in 2023, a 45% increase from the previous year. Investment scams accounted for the majority of these losses, highlighting the ongoing challenges in combating fraud within the crypto space .

Financial criminals exploit several key vulnerabilities in the cryptocurrency ecosystem —

- Layering through multiple wallets

Moving illicit funds through chains of addresses to obscure their origin - Cross-chain transactions

Transferring assets between different blockchains to break transaction trails - Non-custodial wallets

Using self-hosted wallets that don’t require identity verification - Mixing services

Employing services like Tornado Cash to blend transactions, making tracing nearly impossible - DeFi protocols

Exploiting decentralized finance platforms with limited compliance controls

Role of Blockchain Forensics in Transforming AML Compliance

While cryptocurrencies present unique challenges, blockchain technology also offers unprecedented transparency for compliance professionals who leverage the right tools and techniques.

Blockchain forensics has emerged as a critical discipline that applies advanced analytics, machine learning, and network analysis to cryptocurrency transactions. These techniques enable compliance teams to —

- Trace transaction flows

Follow cryptocurrency movements across multiple blockchains, exchanges, and wallet services - Identify high-risk addresses

Flag addresses associated with sanctioned entities, darknet markets, or known fraud schemes - Detect suspicious patterns

Identify transaction behaviors that match money laundering typologies - De-anonymize entities

Link cryptocurrency addresses to real-world identities through clustering algorithms - Audit smart contracts

Analyze code vulnerabilities and transaction patterns in decentralized applications

“Blockchain forensics represents a paradigm shift for financial crime prevention,” explains Tasneem Abdulrahman – Director – Compliance Delivery at Anaptyss. “The transparent nature of blockchain technology actually gives investigators advantages they never had with traditional financial systems—if they know how to leverage the right analytical approaches.”

Regulatory Developments Driving Forensic Adoption

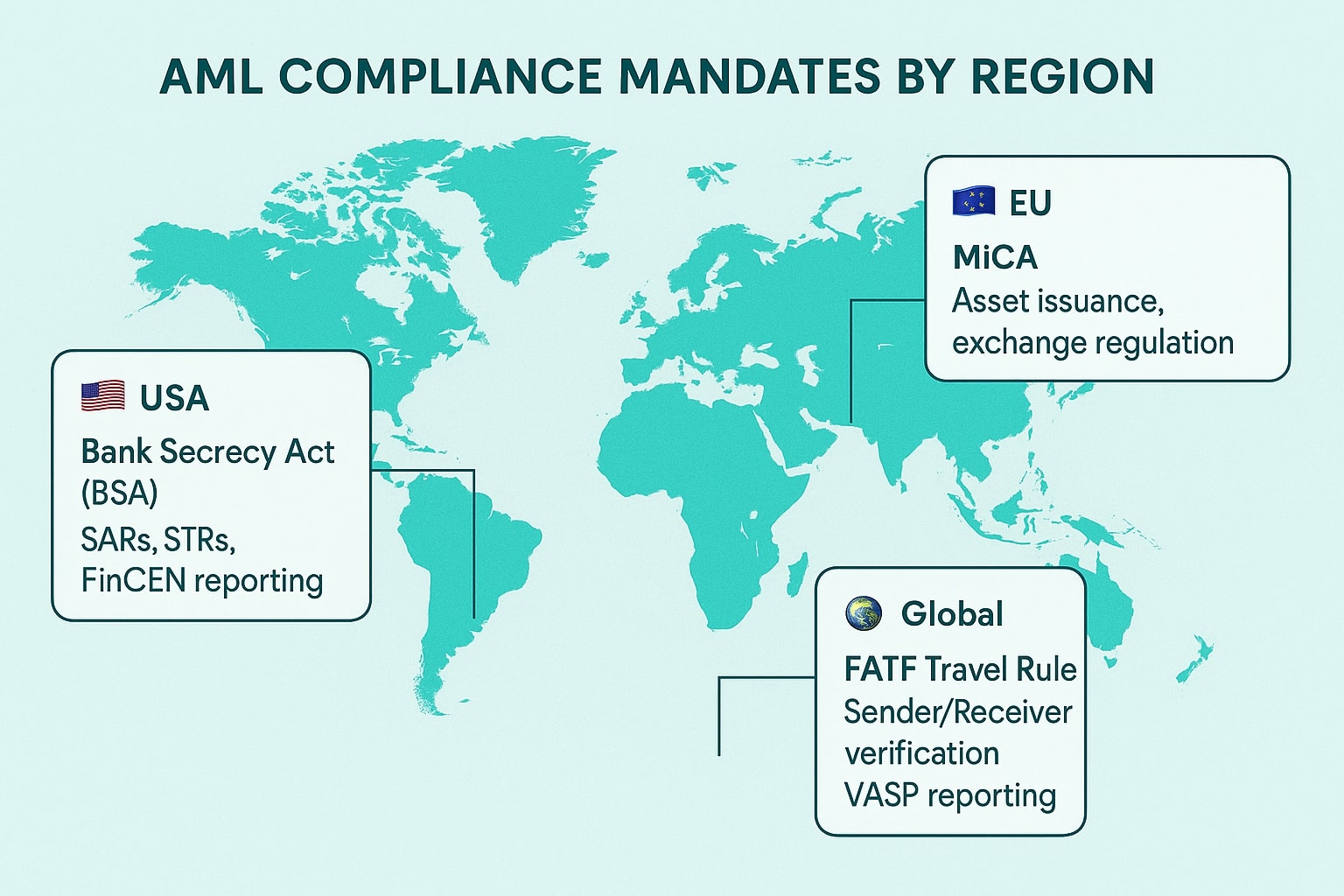

Regulatory frameworks worldwide are evolving rapidly to address cryptocurrency risks, creating new compliance obligations for financial institutions and virtual asset service providers (VASPs).

- The Financial Action Task Force (FATF) Travel Rule now requires VASPs to collect and share information about transaction senders and recipients

- The EU’s Markets in Crypto-Assets (MiCA) regulation establishes comprehensive requirements for crypto-asset service providers

- The US FinCEN’s proposed rules aim to extend AML requirements to non-custodial wallet transactions

- The Bank Secrecy Act (BSA) now explicitly encompasses cryptocurrency exchanges and service providers

These regulatory developments have accelerated the adoption of blockchain forensics tools and methodologies across the financial sector.

Real-World Applications Changing Financial Crime Detection

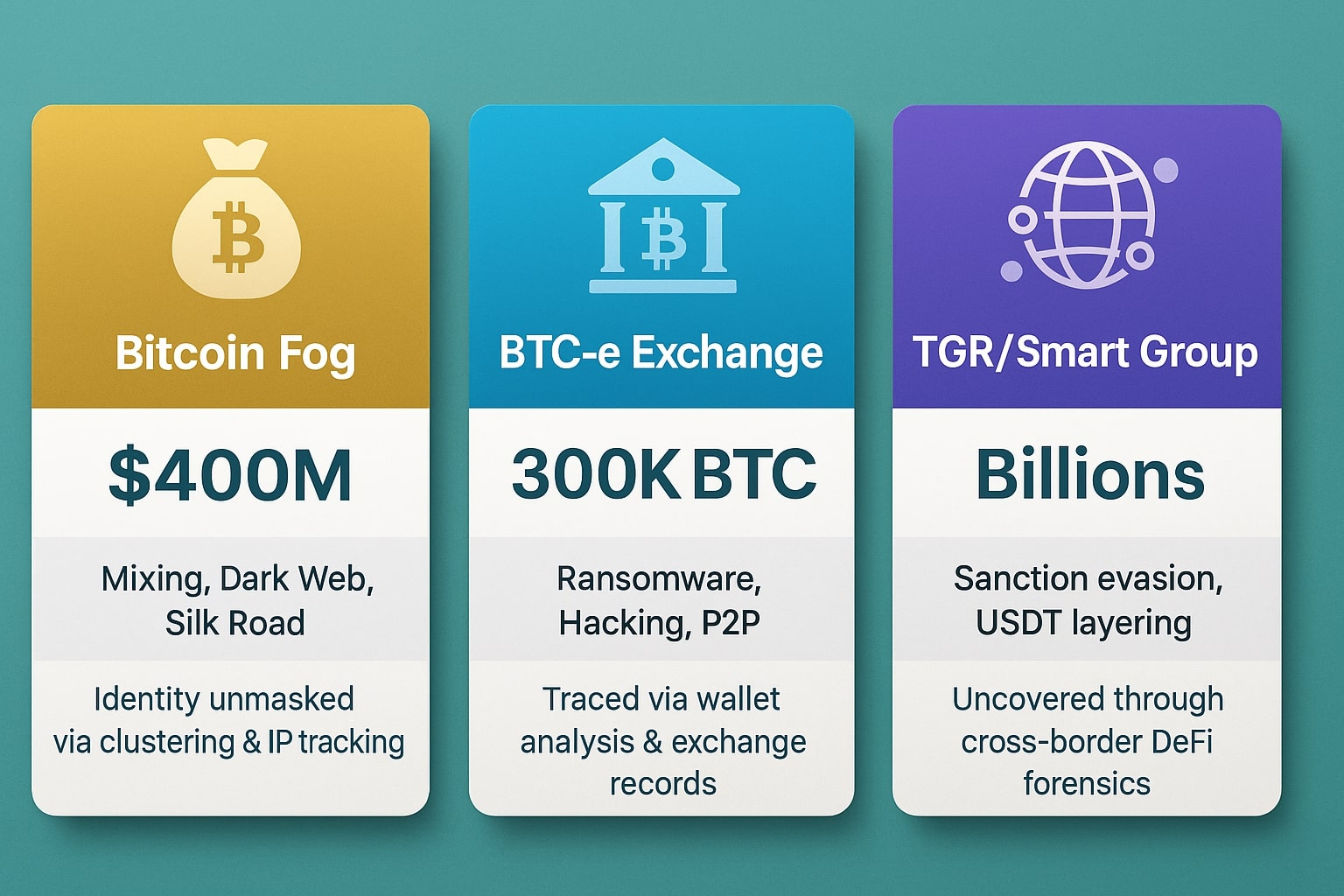

Case studies demonstrate the effectiveness of blockchain forensics in combating financial crime.

Challenges in Blockchain Forensics Implementation

Despite its potential, implementing effective blockchain forensics presents several challenges —

- Technical complexity

Analyzing blockchain data requires specialized knowledge and tools - Resource constraints

Smaller institutions struggle to invest in sophisticated analytical platforms - Cross-chain visibility

Maintaining visibility across hundreds of different blockchains and layer-2 networks - Privacy coins

Transactions in currencies designed for anonymity (Monero, Zcash) resist traditional forensic analysis - Rapid innovation

New obfuscation techniques continuously emerge, requiring constant adaptation

Building an Effective Blockchain Forensics Program

Financial institutions can enhance their cryptocurrency compliance programs by—

- Investing in specialized tools

Implementing blockchain analytics platforms that provide transaction monitoring and risk scoring - Developing internal expertise

Training compliance staff on cryptocurrency typologies and blockchain analysis techniques - Establishing risk-based procedures

Creating cryptocurrency-specific risk assessments and due diligence protocols - Collaborating with regulators

Engaging proactively with regulatory bodies to align compliance approaches - Participating in information sharing

Joining industry initiatives that share threat intelligence on emerging risks

For a deeper dive into cryptocurrency accounting challenges and forensic solutions, download our complete white paper: “Cryptocurrency Accounting & Blockchain Forensics” and discover how leading organizations are transforming their approach to digital asset compliance.

The Future of Cryptocurrency Compliance

The cryptocurrency compliance landscape is evolving toward greater integration of automated analytics, artificial intelligence, and cross-platform visibility. Forward-thinking institutions are developing programs that —

- Implement real-time transaction monitoring across multiple blockchains

- Integrate on-chain and off-chain data sources for holistic risk assessment

- Deploy machine learning to detect emerging typologies and anomalous patterns

- Automate regulatory reporting for cryptocurrency transactions

- Adopt blockchain-native compliance solutions that operate within DeFi protocols

Enhance Your Cryptocurrency Compliance Strategy

Understanding blockchain forensics has become essential for compliance professionals navigating the complexities of cryptocurrency regulation. To deepen your expertise in this rapidly evolving field, join our upcoming webinar, “Cryptocurrency Compliance: Leveraging Blockchain Forensics for Effective AML Programs.”

In this comprehensive session, industry experts will explore —

- Advanced transaction tracing methodologies for cryptocurrency investigations

- Implementing practical compliance workflows for virtual asset service providers

- Case studies demonstrating successful application of blockchain forensics

- Emerging regulatory expectations for cryptocurrency transaction monitoring

- Future trends in blockchain analytics and compliance automation

As the cryptocurrency ecosystem continues to evolve, proactive adoption of blockchain forensics capabilities will distinguish compliance leaders from those playing catch-up in this dynamic regulatory environment.

Ready to strengthen your cryptocurrency compliance program? Contact us at info@anaptyss.com and let our experts at Anaptyss help you implement effective blockchain forensics solutions.