For any bank or lending institution, their loan portfolio is both the engine of profitability and its greatest source of vulnerability.

Lending is the principal business activity for most banks. Their loan portfolio is the largest asset and predominant source of revenue. At the same time, it is also the single greatest source of risk to a bank or lending institutions’ safety and soundness.

Historically, weak credit standards, poor monitoring, and inadequate portfolio management have been the central drivers of bank losses and failures.

Nowadays, this challenge has become even more acute. For instance, Banks and lending institutions are experiencing a convergence of economic volatility, fluctuating interest rates, competitive pressures, and intensifying regulatory expectations. As a result, traditional portfolio monitoring methods—such as delinquency rates and non-accrual trends—are proving to be insufficient and lagging. By the time they flag distress, the window for effective corrective action is often gone.

At the same time, the risk landscape has expanded. Beyond pure credit risk, institutions must contend with operational risk, compliance challenges, legal exposure, reputational pressures, and emerging enterprise risks that directly shape portfolio outcomes. Climate risk, for example, is increasingly factored into expected credit losses as extreme weather events and transitional policies reshape borrower performance. As discussed in one of our previous blogs on ERM benefits for banks, this shift demands governance that is not reactive but proactive and strategic.

In this blog, we discuss how Risk & Control Self-Assessment (RCSA) can help banks and lending institutions move beyond compliance and build proactive, strategic loan portfolio governance frameworks.

The Role of RCSA in Strengthening Loan Portfolio Governance

Risk & Control Self-Assessment is a structured, organization-wide process for identifying, assessing, and mitigating risks and controls. It’s the “Self-Assessment” element that makes it transformative as it empowers the first line of defense (the core business teams) to own the evaluation of their risks and controls.

Thus, RCSA helps create both a cultural and strategic pivot:

- Business units move beyond compliance to proactively safeguard performance and resilience.

- Risk management shifts from audit-driven snapshots to continuous discipline embedded in daily operations.

- Findings highlight the most material risks affecting strategic objectives and external business conditions.

- Over time, RCSA embeds risk awareness across the enterprise, strengthening governance, risk culture, and board-level oversight.

An effective RCSA program fosters accountability and transparency. It builds a two-way feedback loop where the institution’s strategy and risk appetite shape the scope of assessments, and the assessments themselves inform future strategy.

Applying RCSA Across the Loan Lifecycle

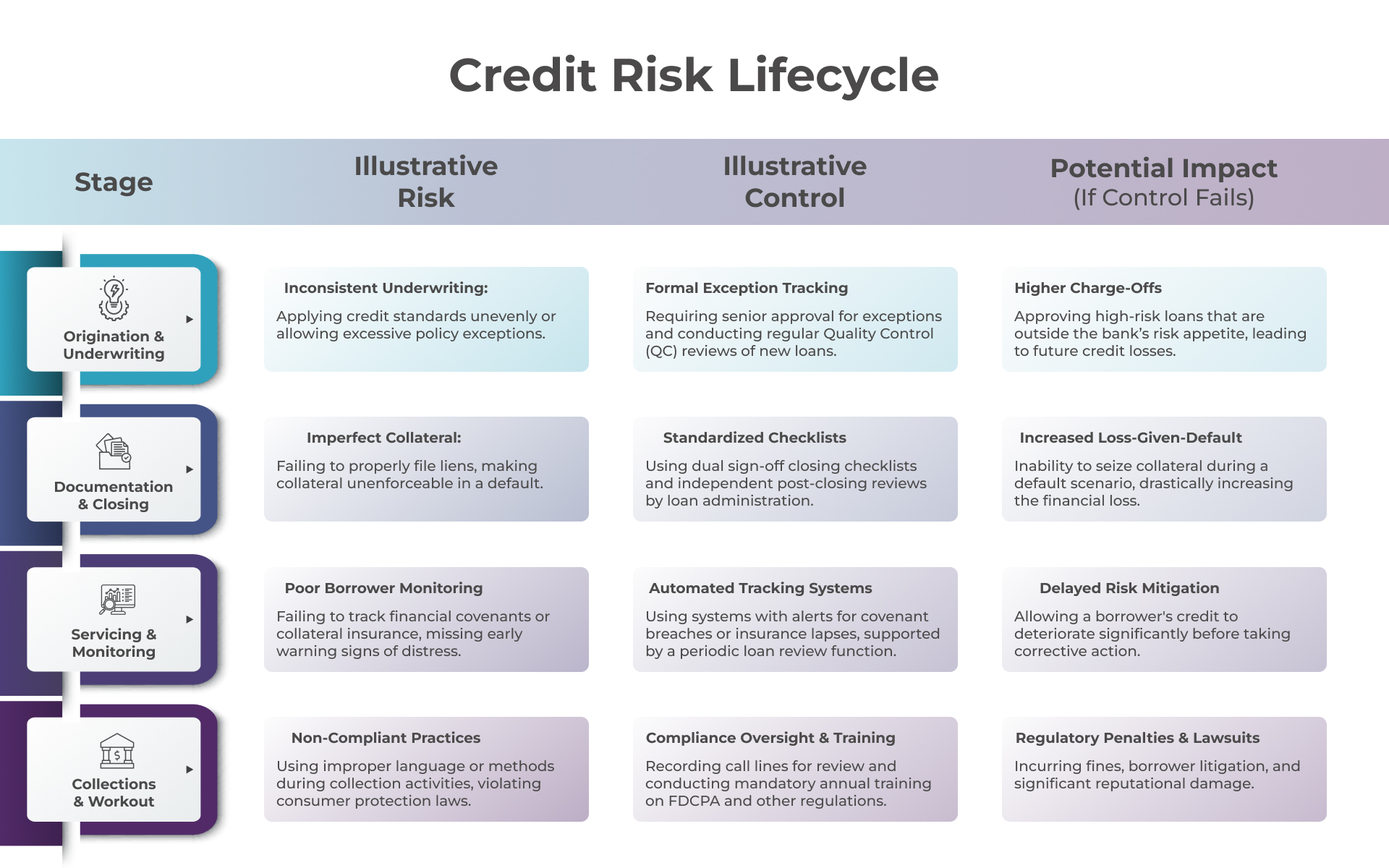

The power of RCSA lies in its application to specific processes within the loan lifecycle. By systematically mapping risks and controls across origination, documentation, servicing, and collections, institutions can expose operational blind spots that often manifest as credit losses. By embedding RCSA into these processes, institutions can shift from treating operational failures as isolated breakdowns to recognizing them as direct contributors to portfolio losses.

By embedding RCSA into these processes, institutions can shift from treating operational failures as isolated breakdowns to recognizing them as direct contributors to portfolio losses.

Operationalizing RCSA for Effective Governance

For RCSA to deliver real impact, it must move beyond a checklist exercise. An effective program is anchored in the three lines of defense model—a framework we explored in detail in our blog on the Three Lines of Defense in Risk Management.

- First Line (Lending, Servicing, Collections)

These are the owners of risks and controls. They perform self-assessments, identify control gaps, and implement action plans to remediate weaknesses. Their role ensures that risk accountability begins at the source of activity. - Second Line (Risk Management, Compliance)

This layer designs and maintains the RCSA framework, develops tools and training, provides oversight, and independently challenges the first line’s assessments. - Third Line (Internal Audit)

Provides independent assurance to the board that the RCSA framework itself is well-designed, consistently applied, and effective.

The RCSA process follows a disciplined cycle, which involves –

- Scoping & Planning – Define priorities based on business strategy, regulatory requirements, and risk appetite.

- Information Gathering – Conduct workshops, distribute structured questionnaires, and gather data across business lines.

- Assessment – Use standardized scoring methods to evaluate inherent risk, control effectiveness, and resulting residual risk.

- Action Planning – Develop SMART remediation plans with clear accountability and deadlines.

- Reporting & Monitoring – Provide visibility through dashboards, heat maps, and trend analysis to inform decision-making at the executive and board level.

What distinguishes a successful RCSA program is not just the identification of risks, but the closing of the loop through actionable, measurable outcomes that improve governance and portfolio resilience.

Integrating RCSA into Enterprise Risk and Capital Planning

When matured, RCSA evolves into more than an operational safeguard; it becomes a strategic enabler for the institution. Its insights directly strengthen enterprise risk management and capital planning:

- Strengthening Stress Testing

RCSA findings bring qualitative depth to quantitative stress test scenarios.

For instance, if assessments reveal systemic weaknesses in collateral management, stress tests can adjust LGD assumptions accordingly—making models more realistic and institution-specific. - Supporting ICAAP and Basel III Compliance

Regulators are pressing forward with the implementation of Basel III and the forthcoming Basel Endgame standards. These frameworks require banks to present a comprehensive, forward-looking view of all material risks—including operational risks—within the Internal Capital Adequacy Assessment Process (ICAAP).

RCSA provides the structured, bottom-up evidence needed to meet these expectations. For instance, control effectiveness ratings, emerging risk trends, and scenario analysis inputs that can be directly integrated into ICAAP and broader capital planning. For a deeper perspective on Basel III, see our white paper on Operational Risk Modelling in Banking: Basel III Frameworks. - Refining Risk Appetite

Aggregated RCSA outputs—such as heat maps—give boards a clear view of actual versus desired risk posture. This enables executives to adjust appetite statements based on evidence rather than assumptions, ensuring alignment between strategy and operational reality.

By linking RCSA to these enterprise-level processes, institutions can transform it from a compliance activity into a strategic tool that strengthens resilience, improves capital allocation, and enhances regulatory confidence.

Conclusion

By embedding RCSA into the heart of loan portfolio governance, banks can move from reactive defense to proactive foresight. It connects front-line processes to enterprise strategy, ensuring risks are owned, assessed, and acted upon before they erode portfolio health.

Done right, RCSA transforms loan portfolio governance into a strategic discipline that strengthens resilience, enhances decision-making, and ensures regulatory confidence.

At Anaptyss, we help banks and financial institutions strengthen risk management and governance frameworks through digital, data-driven solutions. Our expertise in operational risk, Basel III/Endgame compliance, and portfolio governance equips financial institutions to embed RCSA effectively and align with regulatory expectations.

To learn more, connect with us at info@anaptyss.com.