Discover how Natural Language Processing (NLP) transforms model risk management by identifying systemic flaws in model portfolios, improving transparency, and strengthening governance across banks and financial institutions.

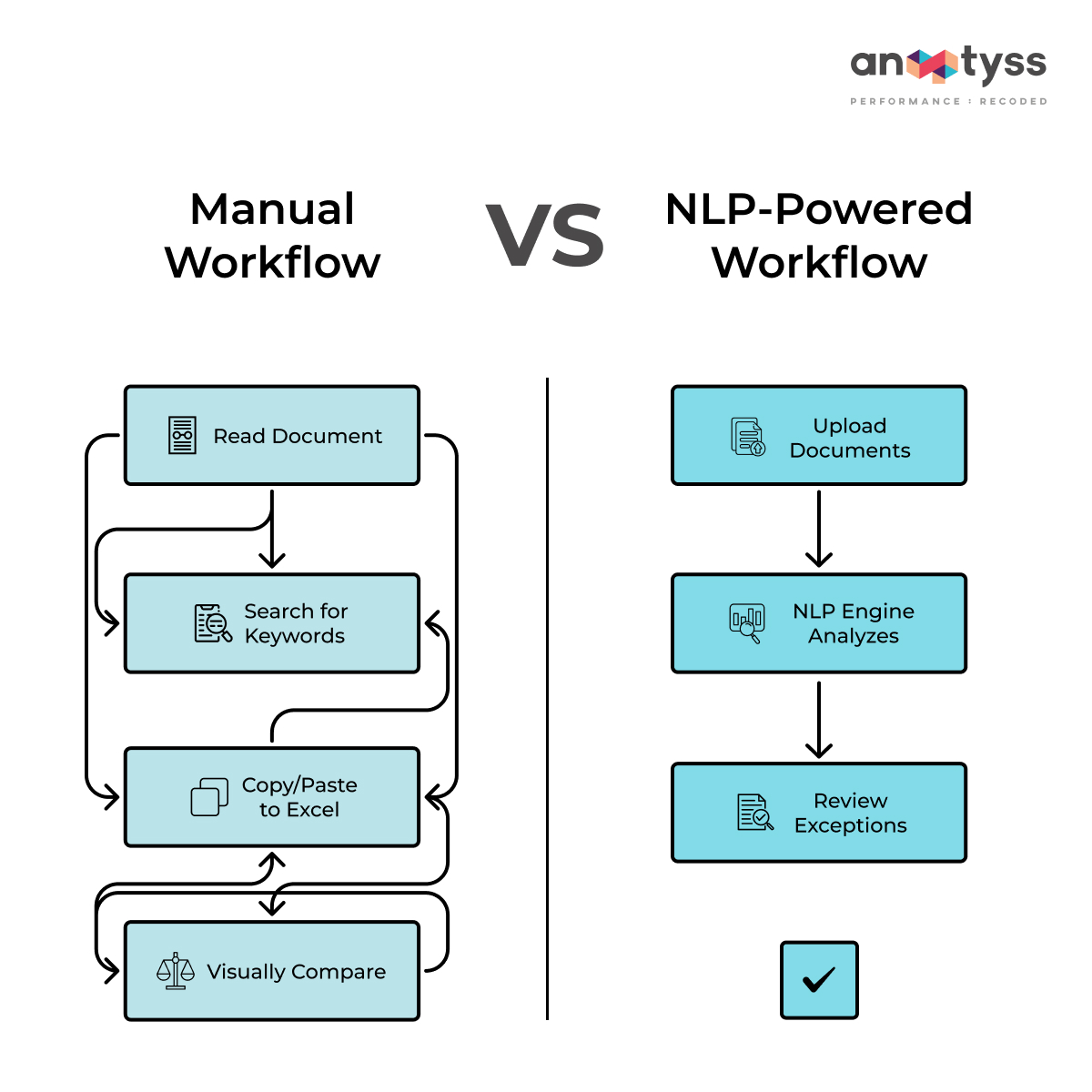

Traditional Model Risk Management (MRM) frameworks, while essential, possess a critical vulnerability. They operate on the visible 10-20% of structured data and therefore, cannot detect systemic, cross-portfolio risks concealed within the overwhelming volume of unstructured data and documentation. It is estimated that 80% all enterprise data in the financial industry is unstructured in the form of emails, reports, documents, etc.

No matter how diligent a team is, they can only process a fraction of this information. More importantly, it’s challenging for them to connect disparate pieces of information spread across different business lines and geographies, which can lead to blind spots.

For instance, a data vendor weakness, a recurring assumption flaw—are often treated in isolation. While they may seem like minor issues, these deeply embedded, systemic flaws can silently grow into significant enterprise-level threats. Global financial institutions faced $6.6 billion in fines in 2023 for non-compliance with AML, KYC, and sanctions regulations. This underscores the high stakes of missing systemic flaws.

This is where role of Natural Language Processing (NLP) emerges. In this blog, we discussed how Natural Language Processing (NLP) provides a necessary layer of intelligence, enabling a shift from reactive, siloed oversight to proactive, strategic governance.

From Isolated Findings to Enterprise-Wide Threats

Consider a common governance blind spot.

- A validation report for a credit card model notes a minor data quality issue from a specific third-party vendor.

- Separately, an auto loan model validation flags a data gap from the same vendor.

- In a third business line, a small business lending model’s documentation mentions a weakness in an assumption based on this vendor’s data.

Individually, each finding is a low-priority footnote. For a human analyst focused on a single model, it is easily dismissed.

However, when aggregated by an NLP engine, these insignificant notes reveal an alarming pattern—a systemic, enterprise-wide dependency on an underperforming vendor. This is not a failure of individual diligence, but a systemic limitation of manual review. For senior leadership, it represents an unacceptable and previously invisible risk.

NLP-powered thematic analysis is designed to unearth precisely these hidden risks. By structuring the unstructured text from thousands of reports, it enables a holistic, enterprise-level view. It identifies recurring themes and connections that are invisible at the individual document level and helps transform the function from task automation to strategic risk detection.

A New Paradigm for Enterprise Risk Management

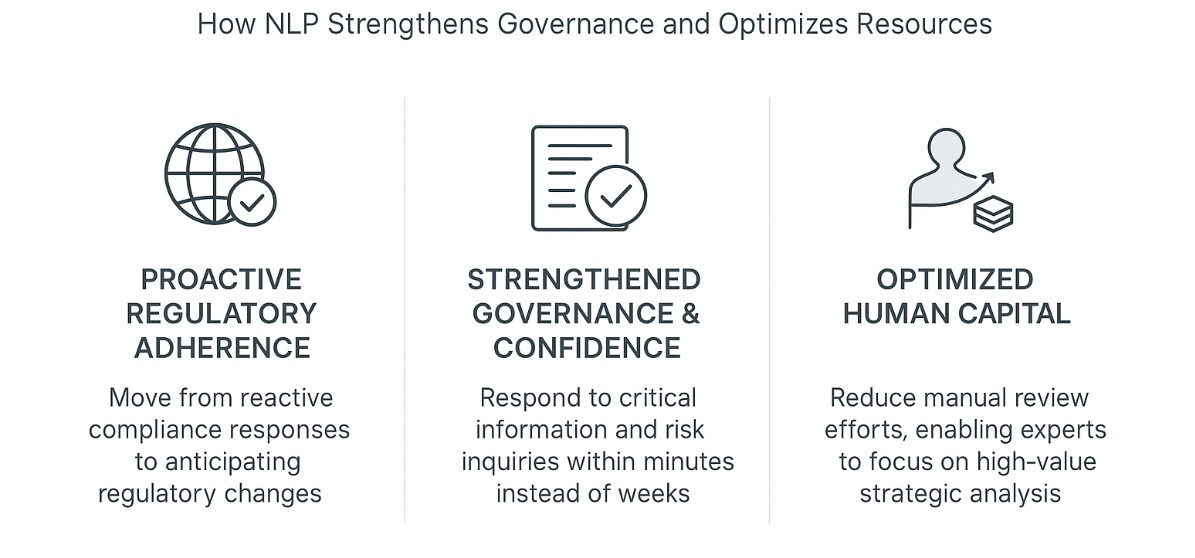

The application of NLP provides a new level of portfolio-wide intelligence that strengthens governance and optimizes resources.

- Proactive Regulatory Adherence

An NLP-powered intelligence system provides early warnings by continuously monitoring global regulatory updates and enforcement actions. This allows the institution to anticipate and strategically prepare for shifts in compliance obligations, rather than reacting to them. - Strengthening Board and Regulatory Confidence

Automated, data-driven governance provides objective evidence of robust oversight. It equips leadership to answer inquiries from the board or regulators with verifiable data instantly. Questions regarding cross-portfolio bias testing in high-risk AI models, for example, can be addressed in minutes, demonstrating a superior level of control. - Optimizing High-Value Human Capital

By automating the rote aspects of documentation review, NLP liberates expert resources—quantitative analysts and senior risk managers—from low-value tasks. This reallocation of capital allows them to focus on strategic priorities, such as exercising “effective challenge” on critical models and advising the business on risk-adjusted growth.

From Reactive Controls to Predictive Governance

The ultimate goal of leveraging NLP is to evolve beyond reactive compliance and build a predictive, strategic governance framework. This means moving from a defensive posture to one of foresight and proactive risk management. The structured intelligence extracted by NLP can be seamlessly integrated into existing Governance, Risk, and Compliance (GRC) platforms and executive dashboards. This provides senior leaders with a dynamic, real-time, and aggregated view of the enterprise model risk landscape, complete with trend analysis and automated alerts.

These principles are not merely theoretical. In practice, leveraging AI and NLP for risk oversight yields significant, quantifiable results. For instance, by applying machine learning to the validation of third-party credit risk models, Anaptyss empowered a regional bank to achieve a 40% faster validation lifecycle, while another client realized over $400,000 in annual savings by deploying an ML-based credit risk model. These outcomes demonstrate the tangible value of moving beyond manual, document-centric reviews to an intelligent, data-driven approach.

At Anaptyss, we understand that mastering your data is the key to mastering risk. Our solutions, powered by our proprietary DKO™ (Digital Knowledge Operations) framework, integrate AI-powered technologies like NLP with deep-domain consulting. We empower financial institutions to move beyond the limitations of traditional MRM and unlock a new level of portfolio-wide risk intelligence. To explore this subject in greater detail and learn how to apply these principles in your own institution, download our exclusive white paper.

To understand how NLP-driven intelligence can enhance your firm’s governance and risk posture, reach us at info@anaptyss.com or schedule a confidential executive briefing with our domain leaders.