Legacy OCR can’t meet 2026 regulatory expectations. Discover why commercial lenders must shift to AI-driven document intelligence for accuracy and compliance.

The commercial lending industry currently exists in a state of cognitive dissonance. On the surface, banks are showcasing digital portals, workflow engines, and automation pilots. Yet behind this digital façade lies a stubborn analog reality: the ecosystem still runs on paper-heavy loan files, unstructured covenants, scanned PDFs, and decades-old documentation workflows.

As of 2025, lenders collectively generate and process billions of pages of documents—credit agreements, term sheets, collateral descriptions, financial statements, audits, guarantor documents, compliance certificates, and more.

For the last decade, financial institutions have used Optical Character Recognition (OCR) to bridge the gap between paper-based loan files and digital systems. But as 2026 approaches—bringing new Basel IV compliance structures and heightened supervisory scrutiny—OCR is becoming a crumbling bridge. It created what analysts now call the “Paperless Illusion”: the misconception that scanning documents into PDFs constitutes digitization.

To survive the coming shift, commercial lending must move from basic text extraction to true data intelligence.

Where Legacy Technology Falls Short

The “Paperless Illusion” persists because the industry underestimated the complexity of unstructured legal and financial data.

A PDF of a loan agreement or covenant package is, to a computer, just an image. It provides no semantic meaning.

OCR acts as a reader—it sees text.

But commercial lending requires a reasoner—a system that understands legal, financial, and contextual relationships.

OCR can read the word “Leverage,”

—but it cannot determine whether it refers to:

-

a financial covenant,

-

a waiver request,

-

a ratio test, or

-

a compliance requirement tied to reporting timelines.

Traditional OCR is deterministic. It relies on templates and positional rules. This works for standardized forms—but fails miserably for loan packages, where each borrower’s attorney, accountant, and collateral agent produces documents in different formats.

If one law firm moves a “Debt Service Coverage Ratio” clause to a new section, legacy OCR breaks.

OCR vendors often claim high accuracy, but in lending workflows—filled with cross-referenced clauses, tables, signatures, and amendments—accuracy often collapses to 60% or lower.

In covenant monitoring, underwriting, and loan review, a 40% error rate is catastrophic.

Why is 2026 the Deadline for Moving Legacy OCR

2026 is the year where technological debt becomes a regulatory liability—primarily for two reasons.

1. Basel IV and Capital Requirements

New capital standards taking effect on April 1, 2026 tie operational risk capital charges to historical loss events.

OCR-driven errors—misinterpreting covenants, missing collateral details, failing to extract financial ratios—create data risk that directly raises operational risk capital.

A loan file misread by OCR may force the bank to apply higher risk weights, directly cutting into ROE.

2. Heightened Supervisory Expectations for Data Accuracy

Regulators are intensifying expectations around:

-

data lineage

-

model inputs and outputs

-

covenant tracking

-

credit risk grading

-

collateral validation

-

automated audit trails

Legacy OCR cannot meet these standards. It produces unverified text, not structured, trusted data.

As lenders move into automated credit decisioning, digital loan monitoring, and real-time covenant intelligence, OCR becomes a blocker—not an enabler.

Agentic AI and Intelligent Document Processing (IDP)

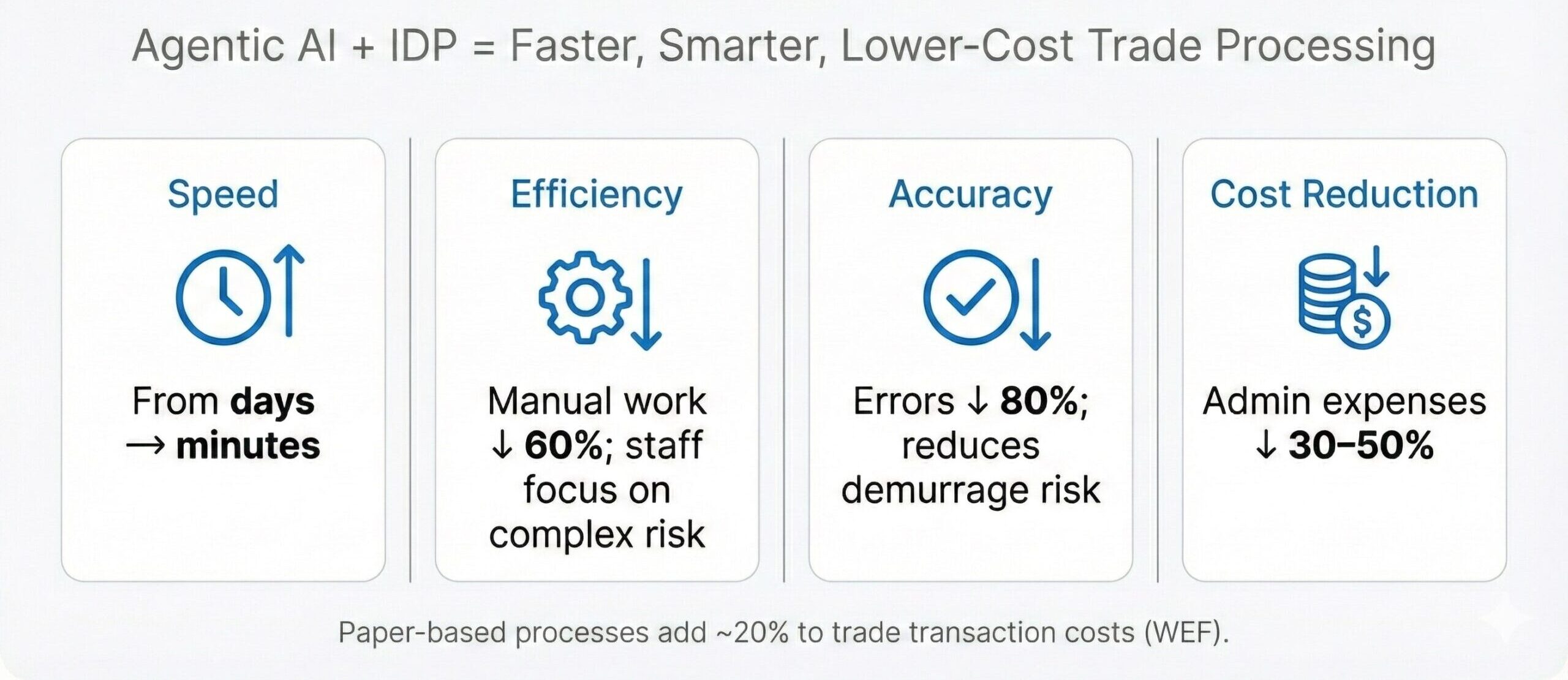

To move beyond the paperless illusion, financial institutions must transition to Intelligent Document Processing (IDP) powered by Generative AI and “Agentic” workflows.

Unlike OCR, IDP combines computer vision, Natural Language Processing (NLP), and Machine Learning to understand documents contextually. It does not rely on brittle templates. Instead, it utilizes AI agents—specialized digital workers—that can classify documents, extract fields, and even perform logical reasoning.

For example, in a covenant compliance process, an AI agent can automatically —

-

Read the borrower’s financial statement

-

Extract EBITDA, Total Debt, DSCR, and leverage

-

Apply definitions from the specific credit agreement

-

Calculate ratios

-

Determine compliance

-

Flag variances or risks before any human review

This shift from recognition to reasoning unlocks true digital lending.

Conclusion

The commercial lending industry is experiencing a digital paradox. While institutions display modern portals and workflow tools, the underlying engine remains paper-bound and error-prone.

For years, OCR acted as the bridge between paper and digital—but that bridge is now collapsing. The Paperless Illusion can no longer meet Basel IV expectations, supervisory accuracy requirements, or modern data governance standards.

CovenAce changes the game.

By combining AI-driven reasoning with human-in-the-loop oversight, it transforms unstructured loan documents, covenants, and financial statements into trusted, regulatory-ready data assets.

It enables faster extraction, near-perfect accuracy, automated discrepancy detection, and complete audit trail transparency.

This is the future of commercial lending data intelligence—and it starts by moving beyond OCR.

Future-proof your lending operations with CovenAce. Contact info@anaptyss.com.