A single credit misjudgment can jeopardize a bank's financial health and reputation. In an industry where lending forms the backbone of operations, mastering credit risk management is paramount. This article delves into the essential processes, best practices, and innovative techniques that banks can employ to assess and mitigate credit risks effectively, ensuring robust financial health and sustained profitability.

Credit risks can severely impact a bank’s financial stability and reputation and can appear in many forms such as loan defaults, liquidity issues, adverse market events, moral hazards, etc. Systematic credit risk management can curtail and mitigate these significantly, provided appropriate measures are taken.

Among all, following appropriate processes, techniques, and practices is crucial, and this blog sheds light on these execution-related aspects of credit risk management.

8 Best Practices in Credit Risk Management Processes

Best practices for credit risk management enable banks and financial institutions to minimize potential risks and ensure the financial stability of the business. These best practices include a combination of credit risk measurement, policies, and monitoring techniques, such as:

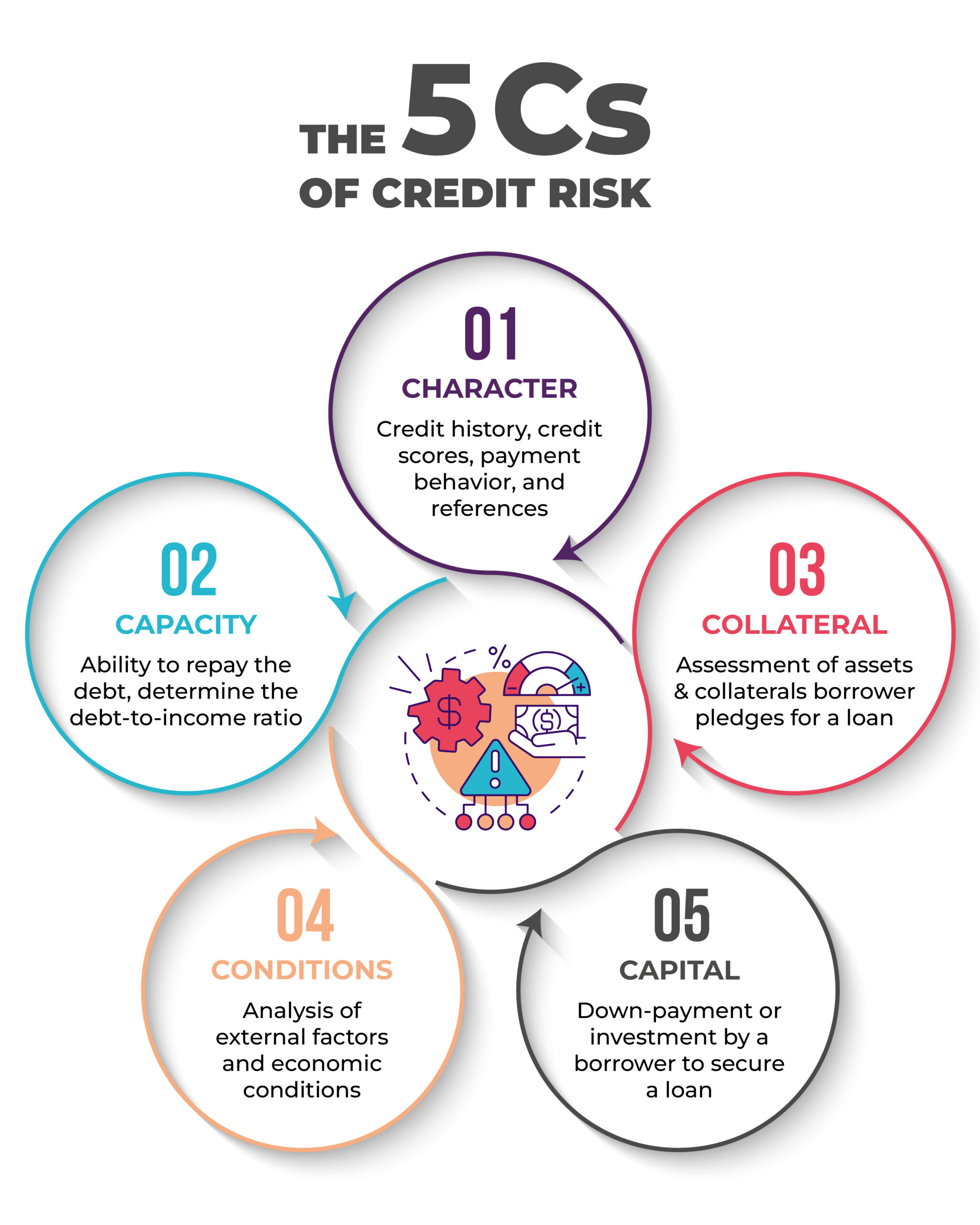

1. Consider the 5Cs of Credit Risk

The 5Cs of credit risk provide banks and lending institutions a framework to identify the inherent risks in lending and mitigate credit risks. The 5Cs are:

- Character

Evaluates counterparty’s or borrower’s credit history, credit scores, payment behavior, and references - Capacity

Assessment to determine the ability to repay the debt and ascertain the debt-to-income ratio - Collateral

Evaluation of assets & collaterals borrower pledges for a loan, essential for credit risk mitigation - Conditions

Analysis of external factors and economic conditions that may impact the loan terms and borrower’s ability to repay. - Capital

It is the down payment or investment done by a borrower to secure a loan. This helps banks mitigate credit risk in case of a default.

2. Robust Credit Policies & Procedures

Prepare credit policy with well-defined criteria outlining the guidelines and procedures for making decisions to safeguard the bank against financial risks and set the foundation for effective credit risk management. It should clearly state the terms of sale, credit extension, and collection process.

3. Robust Underwriting Standards

Robust underwriting standards are the stringent and well-defined guidelines for banks and financial institutions that help them ensure only eligible and low-risk individuals or entities are approved for loans and safeguard against excessive risk, minimize adverse selection, and maximize profitability.

It also helps determine:

- Amount of debt that should be issued

- Terms of loan

- Interest rates

The Federal Deposit Insurance Corporation (FCIC), although does not set underwriting standards, it does have guidelines and best practices that banks can follow in their underwriting process. These include:

- Evaluate the applicant’s repayment willingness and capacity.

- Review credit history and performance on past and existing obligations.

- Assess income, including self-employment and investment income.

- Consider the borrower’s overall credit relationship with the bank.

4. Adequate Allowance for Loan and Lease Losses (ALLL)

The purpose of ALLL, originally referred to as ‘reserve for bad debts,’ is to estimate credit losses in the bank’s portfolio of loans and leases. Banks and financial institutions must maintain ALLL to absorb estimated credit losses in the bank portfolio of loans and leases. By maintaining appropriate ALLL, banks and financial institutions ensure that they have sufficient funds to cover potential credit losses and maintain adequate allowances.

As per FDIC, banks must develop a program to establish and regularly review the adequacy of its allowance, critical to cover the inherent loss. For this, banks must:

- Understand the purpose of the allowance

- Identify bad loans promptly

- Implement a robust analytical process for estimating inherent losses in their loan and leases portfolio

5. Credit Risk Monitoring Processes

Regular monitoring and assessment of the ongoing developments and changes in the borrowers’ risk profile are crucial for banks to identify and manage potential credit risks. It involves:

- Periodic credit assessment

- Account Review

- Timely follow-up on overdue payments

- Implementing effective collection strategies

This helps banks get alerts and respond to changes promptly and minimize losses. These changes include:

- Changes in credit score (increase/decrease)

- Bankruptcy files

- Business structure or location change

- Company out of business

- Lawsuit or lien

- Change in management

Credit monitoring enables banks to make informed decisions, such as placing accounts on hold in case of a lawsuit, lien, or adverse judgment.

6. Stress Testing

Regular stress tests help banks and financial institutions identify potential sources of credit risk and vulnerabilities in the loans and lease portfolio. Stress testing helps banks:

- Analyze the ability to withstand recession

- Impact of adverse economic conditions

- Find weaknesses or vulnerabilities

- Ensure they have sufficient capital adequacy ratio (CAR) to withstand adverse conditions

- Meet regulatory compliance

- Communicate risk to all stakeholders

7. Scenario-Based Analysis

Similarly, scenario-based analysis helps banks:

- Analyze the impact of specific economic scenario

- Create plausible scenarios

- Estimate potential credit losses

- Identify areas of attention

- Develop risk mitigation strategies

8. Build a Skilled Credit Risk Management Team

Banks and lending institutions must have a skilled credit risk management team with diverse skill sets, including statistical modeling, risk assessment, data analysis, etc. They can hire experienced credit officers, loan underwriters, analysts, etc., with strong analytical and industry knowledge and leverage digital learning solutions to provide a sustainable, efficient, and measurable way to train the workforce in credit risk management. This includes:

- Identifying the relevant skill gaps

- Ensuring Continuous workforce training (skilling, reskilling, and upskilling)

- Assessing expertise and capabilities based on various parameters

- Use New-Age Technologies

By using intelligent digital solutions powered by emerging technologies, such as artificial intelligence (AI), machine learning (ML), blockchain, big data analytics, natural language processing (NLP), robotic process automation (RPA), etc. banks and financial institutions can gain deeper insights into their credit risk exposure and portfolio performance.

Credit Risk Mitigation Techniques

Banks and financial institutions can follow the below-mentioned credit risk mitigation techniques to minimize the adverse impact of credit risks.

1. Diversify Portfolios

Banks and financial institutions must avoid extending credits to a few specific customers or entities to reduce the concentration risk. They can spread the risk exposure by doing investments across various industries, sectors, and borrower types and create a well-diversified credit portfolio.

This in turn helps reduce the impact of adverse events and prevent potential losses. To diversify client portfolios, banks can consider the following key points:

- Diversify in different asset classes, such as stocks and bonds, with different risk levels

- Diversify investment across different industries and sectors to reduce concentration risk

- Invest across borders to avoid geopolitical risks

- Invest in both long-term bonds and short-term investments to minimize risk exposure

2. Obtain Credit Insurance

Banks can obtain credit insurance for an additional layer of protection against credit risk. Credit insurance policies cover a significant percentage of losses that may incur due to borrower defaults or adverse economic impacts.

3. Collateral for Security

Banks and lending institutions can ask the customer or counterparty for assets or collateral to reduce their risk exposure by covering outstanding debts in case of customer default. If a borrower defaults on the loan, the bank or the lending institution can seize the collateral and sell it to recover the losses.

4. Effective Collection Strategies

Effective collection strategies can help banks greatly reduce credit risk and recover outstanding debts. These include:

- Regular follow-ups on overdue payments

- Offering revised payment plans

- Engaging in open communication with the counterparty

5. Collaborate with Credit Reporting Agencies

Banks must leverage credit reporting agencies and use the valuable credit information about their potential customers to assess their creditworthiness and make informed decisions about extending credit or granting a loan to the individual or entity.

Conclusion

Robust credit risk management depends on following appropriate processes, techniques, and best practices. Key imperatives include implementing credit policies, comprehensive credit assessments, portfolio diversification, assets, and collaterals for securing the loan, and continuous credit monitoring.

By implementing the best practices discussed in this blog, banks, and financial institutions can significantly improve their credit risk management strategies, protect themselves from potential losses, and ensure long-term success.

Looking for expertise in credit risk management. Contact us: info@anaptyss.com.