Transaction Monitoring (TM) is critical element of Anti-Money Laundering (AML) compliance and fraud prevention for banks and financial institutions. As the volume and complexity of financial transactions continue to grow, monitoring and identifying suspicious activity becomes increasingly challenging. While automation is essential for maintaining the integrity of transaction systems, it often comes at the cost of generating numerous false positives (FPs).

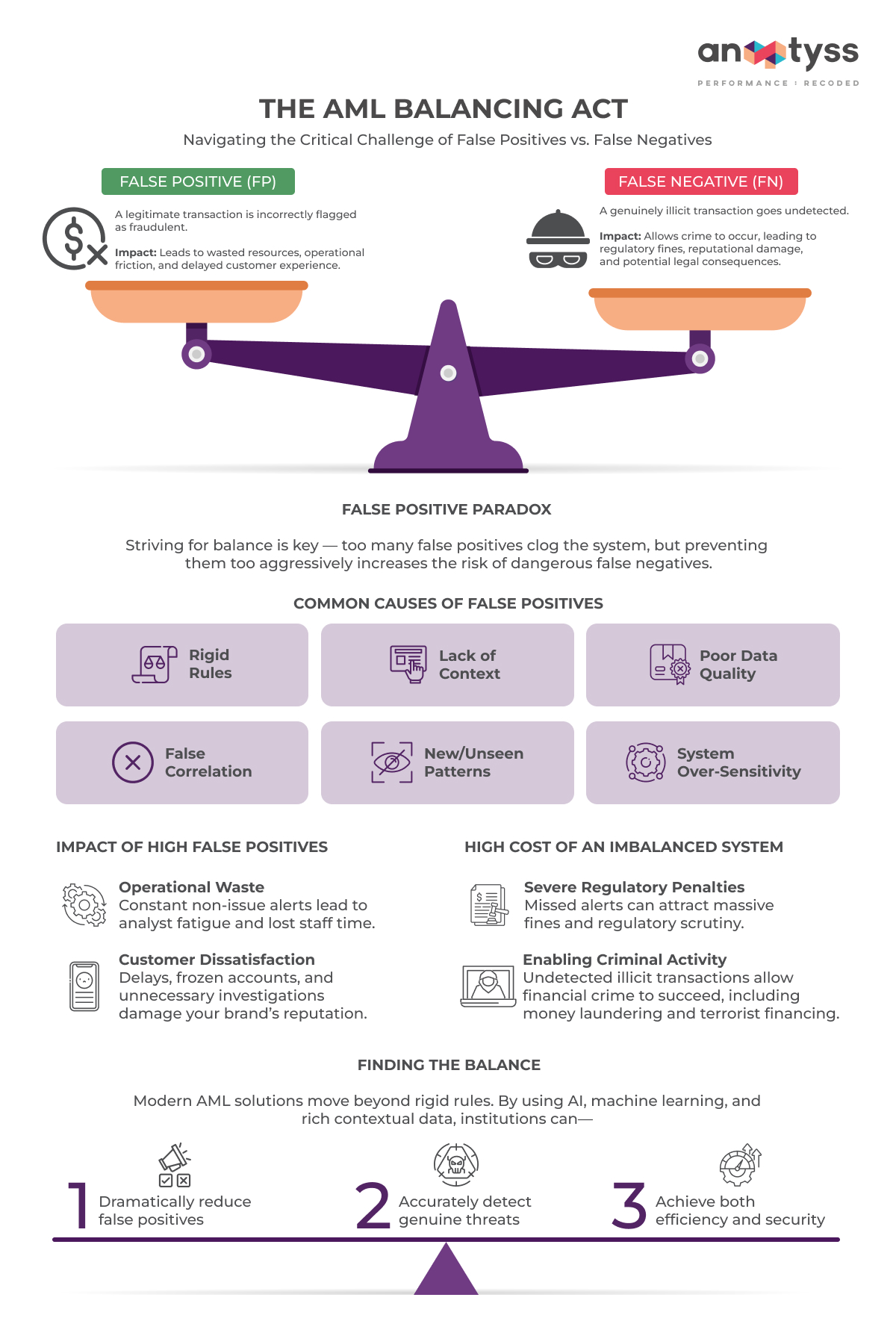

A false positive occurs when a legitimate financial transaction is mistakenly flagged as suspicious or fraudulent by the AML system. Industry estimates suggest that false positives can account for over 95% of AML alerts. This overwhelming volume of noise obscures truly suspicious activity, creating significant operational and regulatory burdens for compliance teams.

For financial institutions, reducing false positives is not merely a technical adjustment but a strategic imperative that reshapes monitoring standards, enhances customer experience, and ensures alignment with evolving regulatory expectations. High false-positive rates lead to immense costs due to manual reviews, damage customer relationships, and divert essential resources away from genuine threats.

In this blog, we have shared the three proven strategies that banks and financial institutions can implement to significantly reduce false positives and improve both operational efficiency and the effectiveness when it comes to their compliance programs.

The False Positive Crisis — Causes, Consequences, and Strategies

In the context of AML, it is essential to distinguish between the two types of monitoring errors.

1. Deploying Advanced AI and Machine Learning Models

The most effective way to modernize transaction monitoring and drastically reduce false positives is by leveraging advanced analytics tools such as machine learning (ML) and artificial intelligence (AI). This shifts monitoring from a priori rules to proactive and predictive methods.

a. Enhanced Detection Accuracy

AI and ML algorithms can identify and flag suspicious transactions more accurately and efficiently than traditional rules-based systems. AI learns from past transaction data to distinguish effectively between legitimate and suspicious activities.

Instead of just flagging a transaction for reaching a preset threshold, AI solutions can correctly detect complicated patterns and behaviors that signal abnormal activity.

Also, unlike static rule-based systems that require periodic manual updates, AI updates data in real-time, making constant adjustments based on changing behavioral patterns and new risks. This continuous learning process helps reduce redundant alerts and improves decision accuracy over time.

b. Predictive Analytics and Alert Prioritization

AI significantly enhances alert management by moving the demand for incident response to machine learning systems rather than human teams.

For instance, machine learning models can be used to predict the likelihood of an alert being genuine or a false positive. For instance, Anaptyss helped a leading US-based commercial lender flag 100% Fraudulent Transactions with Machine Learning Fraud Detection System.

Predictive scoring prioritizes high-risk alerts for immediate investigation while lower-risk alerts (those likely to be false positives) can be monitored more passively or “hibernated”. This allows compliance teams to focus their resources on genuine threats.

By analyzing transaction patterns more accurately, AI-driven solutions significantly reduce the volume of false alerts, allowing compliance teams to spend their time, energy, and resources managing the difficult work of investigating and mitigating actual financial crime.

c. Workflow Optimization and Automation

AI systems streamline compliance processes by automating routine tasks, such as generating Suspicious Activity Reports (SARs). Specialized Generative AI tools can even draft concise, accurate, and compliant SAR narratives, significantly reducing SAR completion time and minimizing human error.

AI tools also assist investigators by providing clear alert summaries and suggesting key evidential findings, guiding the investigator on next steps. Centralized operations command systems enable high-quality investigations and maximum efficiency.

2. Adopting Risk-Based Monitoring and Granular Segmentation

Moving away from the “one-size-fits-all” approach of rigid rules to a sophisticated risk-based approach is essential for reducing false positives and achieving healthier alert rates. This strategy focuses resources on high-risk customers and transactions.

a. Implementing a Risk-Based Approach (RBA)

The Financial Action Task Force (FATF) and the EU promote risk-based approaches to AML compliance.

- Customer Risk Assessment

By assessing the risk profile of each customer (considering factors like business nature, location, and transaction history), financial institutions can determine the appropriate level of monitoring required for their transactions. This ensures that transaction monitoring efforts are targeted and effective, reducing false positives. - Refining Rules and Thresholds

RBA allows institutions to tailor monitoring scenarios to their specific risk profiles, rather than relying on generic, inflexible rules. Institutions must regularly review and adjust alert thresholds based on performance data to maintain a balance between specificity and sensitivity. Testing new rules in a sandbox environment helps evaluate their impact on false positive rates before deployment.

b. Dynamic Risk Scoring and Segmentation

Effective RBA relies on dynamically assessing risk, ensuring that monitoring rules reflect the customer’s actual behavior.

A dynamic risk scoring engine assesses risk based on both onboarding and behavioral risk factors. This score should be continuously updated with new data to maintain accuracy and reduce misidentifications.

For example, in a US-based commercial lender, our AI/ML-powered solution allowed 93% accurate prediction of delinquent and written-off customers, continuously updating risk scores based on transaction and behavioral patterns. For credit risk management, we implemented an ML-based credit risk scoring model that saved $400K annually by dynamically scoring customers and adjusting risk assessments in real time.

Similarly, poor segmentation, which reduces granularity in defining parties and their associated risks, is a cause of increased false positives. Implementing segmentation allows institutions to group customers based on specific traits and behaviors, refining monitoring systems to better understand customer context.

3. Ensuring Data Quality and Contextual Intelligence

Transaction monitoring is effective only when based on accurate and comprehensive data. Addressing data quality issues and enhancing the system’s ability to understand the context of transactions are foundational steps in FP reduction.

a. Improving Data Quality

Poor data quality is recognized as one of the leading causes of false positives.

1. Data Validation and Cleansing

Financial institutions should implement data quality controls, such as data validation and cleansing processes.

Data governance frameworks are necessary to ensure that data is collected, stored, and processed consistently across the organization.

2. Data Structuring

Proper organization of collated data is critical. For example, structuring customer names as first, middle, last names, and titles provides more definition to individual identities, reducing false matches with individuals on sanctions lists due to false correlation.

b. Leveraging Contextual Intelligence

Modern monitoring must go beyond simple transactional data and incorporate richer contextual signals.

For instance, behavioral analytics examines patterns in user interactions, such as login times, navigation paths, and transaction habits. This helps distinguish between normal and suspicious activities. This approach identifies a legitimate user based on their typical behavior, reducing the likelihood of false alarms when transactions deviate slightly from the norm.

Comprehensive solutions integrate data from multiple systems to create a complete view of a customer’s behavior. This includes—

- Know Your Customer (KYC) data

- Transactional records

- External data sources

This approach provides an accurate risk assessment, preventing routine transactions from being incorrectly flagged by keeping the risk profiles continuously updated.

Additionally, layering in signals like email age, IP risk, device setup, and social presence helps institutions better contextualize transactions.

This digital footprint analysis screens out benign anomalies before they trigger alerts, providing a broader view for more accurate risk assessments and fewer false flags.

Conclusion

Addressing false positives is a critical component for banks and financial institutions to ensure compliance, mitigate financial crime, and protect customer relationships. By modernizing AML compliance around false positive reduction, financial institutions can move from resource-intensive manual processes to highly efficient, data-driven systems.

A technology modernization strategy is necessary to tackle high volumes of false positive alerts. However, successfully deploying and fine-tuning these advanced systems requires deep domain expertise in financial crime, risk management, and regulatory compliance. Anaptyss understands that AML processes must be subject to continuous monitoring and improvement. By providing expert advice and ensuring detection logic is regularly audited and recalibrated, Anaptyss helps institutions keep pace with changing customer behavior and evolving money laundering tactics.

To learn how Anaptyss can help strengthen your financial crime compliance program, contact us at info@anaptyss.com.