This blog explores how Generative AI is reshaping financial reconciliation for banks by addressing challenges like high transaction volumes, regulatory demands, and data inconsistencies. It highlights AI's impact on operational efficiency, risk management, and compliance—framed within the Three Lines of Defense model—and includes a real-world case study showing a 45% cost reduction through AI-driven transformation.

With transaction volumes escalating, customer expectations for real-time visibility growing, and regulatory requirements becoming more stringent, traditional manual reconciliation methods are proving inadequate.

Generative AI is emerging as the solution to these challenges, offering sophisticated automation capabilities that go far beyond conventional rule-based systems. McKinsey projects that Generative AI could contribute $200 billion to $340 billion in annual value to the global banking sector by 2025, primarily through enhanced operational productivity.

Operational Challenges in Regional Bank Reconciliation

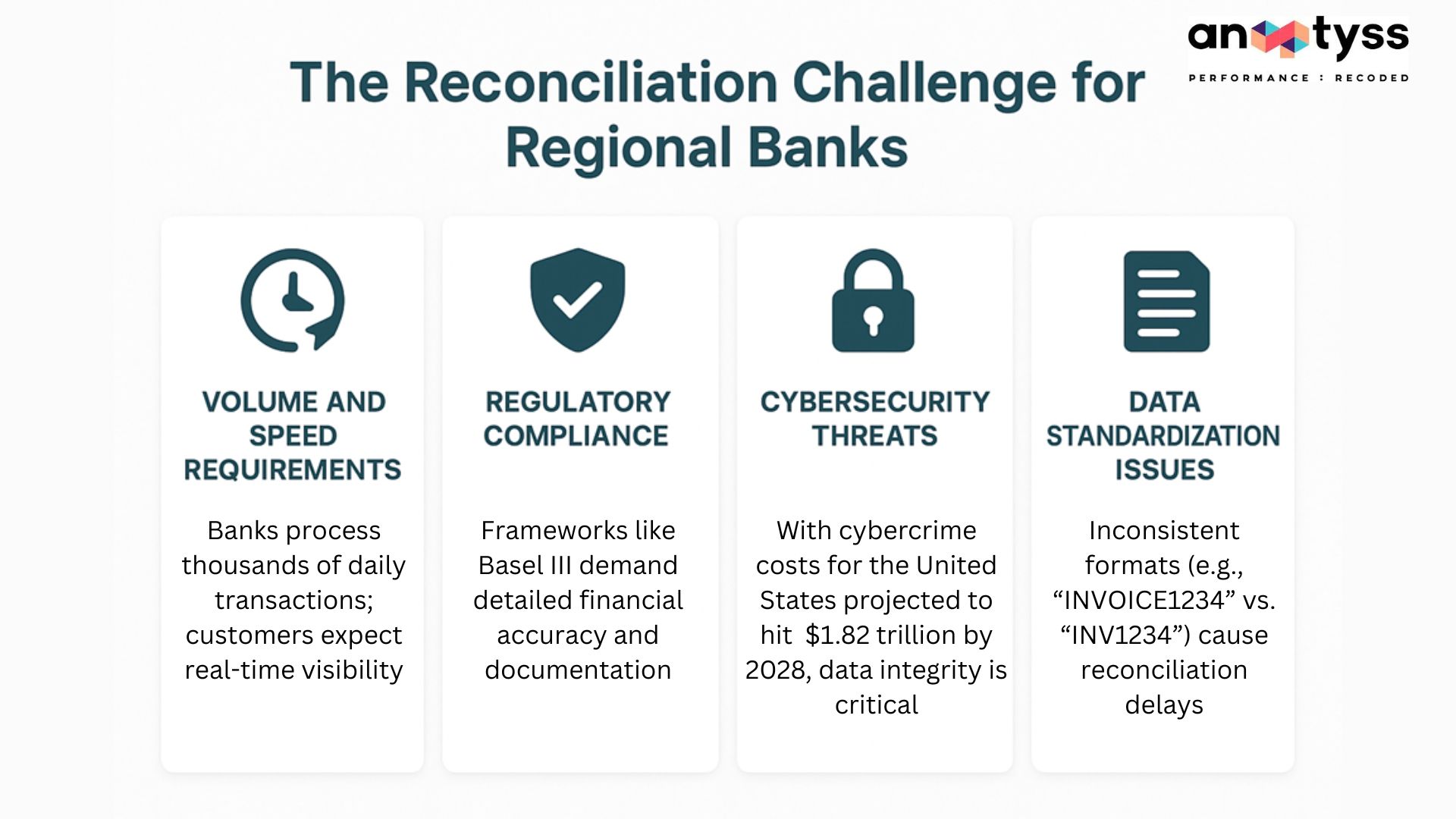

Financial reconciliation—ensuring accuracy and consistency across transaction records—requires precise matching across general ledgers, bank statements, and enterprise resource planning (ERP) platforms. Regional banks face unique operational pressures that make this process particularly challenging.

1. Volume and Speed Requirements

Digital transformation has increased the pace and volume of transactions. Customers now expect real-time account updates, which in turn require near-instant reconciliation processes—something manual methods struggle to keep up with.

2. Regulatory Compliance

Basel III and other frameworks mandate comprehensive risk management and accurate financial reporting. These requirements significantly increase reconciliation complexity, demanding higher accuracy levels and detailed documentation.

3. Cybersecurity Threats

Cybercrime costs in the US reached $452.3 billion in 2024, estimated to reach $1.82 trillion by 2028. And that’s United States alone. Thus, securing financial data during reconciliation is a critical concern. Banks must maintain data integrity while responding quickly to potential threats.

4. Data Standardization Issues

Inconsistent data formats across systems—such as “Invoice 12345” appearing as “INV12345” in different platforms—create reconciliation errors and processing delays that traditional manual methods struggle to resolve efficiently.

How Generative AI Is Changing the Reconciliation Landscape

Unlike conventional AI that analyzes existing data, Generative AI creates new insights and automates complex processes through advanced pattern recognition. The technology’s market growth reflects its transformative potential, with the Generative AI banking market projected to expand from $2.8 billion in 2023 to $75.7 billion by 2028—a remarkable 93.7% compound annual growth rate.

Key Capabilities Transforming Reconciliation

1. Intelligent Transaction Processing

Generative AI processes extensive transaction volumes with unprecedented speed and accuracy, automatically matching records across multiple systems while minimizing manual intervention.

2. Advanced Error Reduction

By automating repetitive tasks, these systems substantially reduce human error rates while ensuring enhanced accuracy in financial record maintenance.

3. Unstructured Data Intelligence

Using sophisticated natural language processing, Generative AI interprets ambiguous data elements, recognizing contextual relationships that traditional systems miss.

4. Predictive Risk Analytics

The technology analyzes historical patterns to predict potential discrepancies, enabling proactive risk management and preventive intervention strategies.

5. Automated Compliance

Generative AI generates comprehensive, audit-ready reports ensuring adherence to regulatory standards while reducing compliance burden.

Aligning AI With Risk Management – The Three Lines of Defense

AI implementation in reconciliation also intersects with risk management practices. Many institutions follow the “Three Lines of Defense” model, which include:

-

Operational Management – Responsible for identifying and managing risks in daily reconciliation activities.

-

Risk and Compliance Functions – Provide oversight, ensure policy adherence, and monitor emerging risks.

-

Internal Audit – Offers independent assurance on the effectiveness of controls and governance processes.

AI technologies can strengthen each of these lines. At the operational level, intelligent automation reduces manual effort and flags anomalies in real-time. For compliance teams, AI enables continuous monitoring and policy alignment. Internal audit functions benefit from data-driven insights and streamlined access to audit-ready reports.

Anaptyss supports this structured approach by aligning its solutions with Basel III and Three Lines of Defense principles. Its AI-driven reconciliation tools are designed to improve risk visibility, enhance operational efficiency, and support regulatory compliance across all levels of the risk management framework.

Case Insight – A Community Bank’s Transformation

A prominent US-based community bank partnered with Anaptyss to address significant reconciliation challenges including extensive backlogs of unreconciled transactions, unstructured data management issues, and inadequate monitoring capabilities.

Anaptyss implemented their proprietary Digital Knowledge Operations™ (DKO™) methodology, deploying a customized Power BI dashboard for real-time transaction monitoring and comprehensive reporting.

Outcomes included:

-

Transparent reporting of all transactions

-

Real-time visibility into reconciliation status

-

Enhanced reporting speed with zero downtime

-

Mobile-enabled KPI dashboards

-

45% reduction in reconciliation-related costs

Adoption Trends and Strategic Considerations

The banking sector’s Generative AI adoption demonstrates accelerating momentum. IBM’s 2025 banking outlook reveals that while only 8% of banks systematically developed Generative AI capabilities in 2024, this percentage is expected to surge dramatically in 2025, with 60% of banking CEOs acknowledging the necessity of accepting calculated risks to leverage automation benefits.

Accenture projects a 30% increase in employee productivity by 2028 through strategic Generative AI adoption. Over 50% of technology leaders in financial services are actively exploring AI applications, with primary focus areas including operational improvement and regulatory compliance enhancement.

Conclusion

Generative AI is not a one-size-fits-all solution—but it offers compelling tools for addressing the persistent challenges of financial reconciliation in regional banking. By rethinking legacy processes through intelligent automation, banks can better meet customer demands, satisfy regulatory expectations, and strengthen operational resilience.

Anaptyss’s AI-powered digital solutions demonstrate the substantial potential for cost reduction, operational improvement, and risk mitigation. Our documented success in achieving 45% cost reduction alongside real-time operational transparency provides compelling evidence of transformative capabilities.

To learn more about how Anaptyss can support your reconciliation modernization journey, contact us at info@anaptyss.com for a consultation or tailored solution discussion.