This blog discusses the importance of optimizing premium collection, mentions some major challenges, and provides insights into key strategies to maximize collection efficiency.

Insurance is a fiercely competitive market, and premium collection is one of the most critical aspects of the insurance industry. It is the lifeblood of the industry, which involves collecting payments or dues from policyholders and ensuring that they receive the coverage they have invested in.

It is estimated that the supplier-customer chain model drives approximately 70% of the overall sales or revenue that any insurance company makes.

In addition, intermediaries (brokers and agents) also contribute significantly to this supplier-customer chain management. The problem is that the intermediaries get the insurance from the insurance companies but they don’t pay for it right away.

Usually, the brokerage models have a 30, 60, or 90-day credit-line period. Failing to collect these payments effectively can cause trouble for the insurer and the insured, sometimes with severe consequences.

Therefore, insurance companies need to streamline their premium collection process and methods to sustain operations and achieve profitability while meeting regulatory requirements.

The Importance of Optimizing Premium Collection Strategies

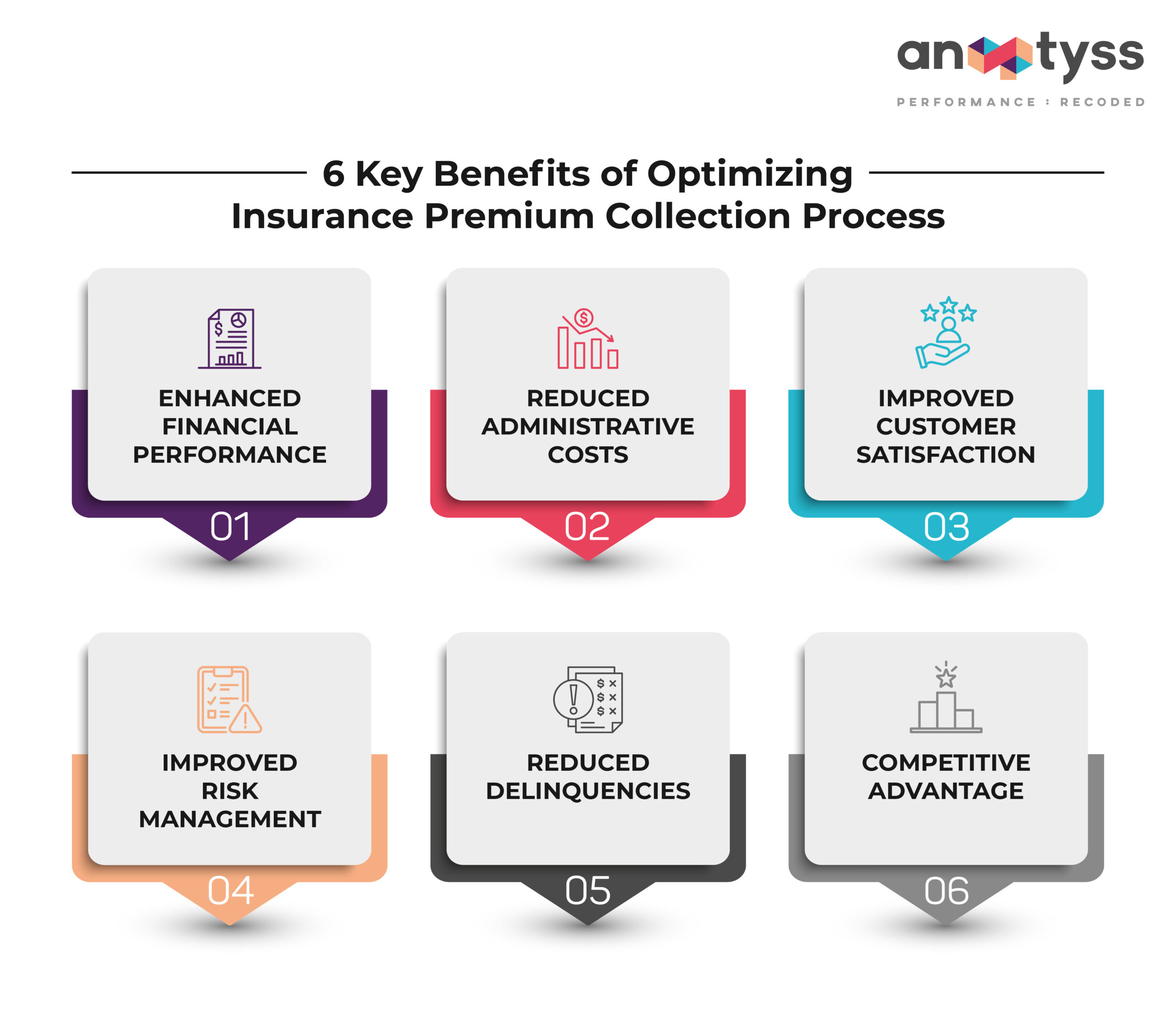

Optimizing the premium collection process can help insurance companies streamline cash flow and plug revenue leaks, resulting in the following benefits:

- Enhanced financial performance

- Reduced administrative costs

- Improved customer satisfaction

- Improved risk management

- Competitive pricing to policyholders

- Reduced delinquencies and late payments

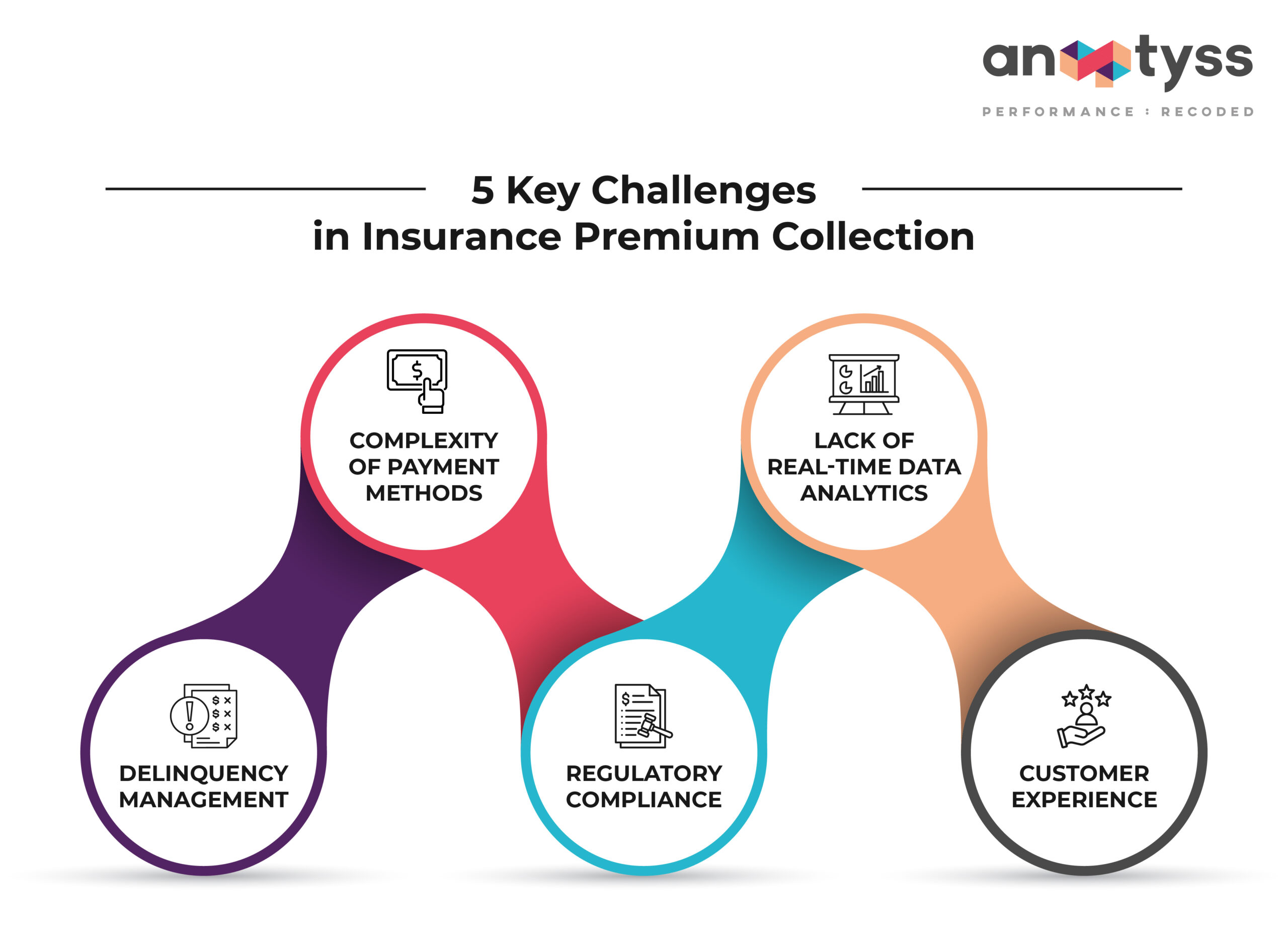

Challenges in Insurance Premium Collection

There are three major challenges that insurance companies face when it comes to premium collection:

1. Complexity of Premium Payment Methods

Traditional payment methods, such as checks and cash, are prone to error and can be time-consuming and inconvenient for policyholders. This can lead to delays in premium collection and may increase administrative costs for insurers.

2. Lack of Real-Time Data Analytics and Monitoring

Many insurers still rely on legacy systems that do not offer real-time insights related to premium payments, customer behavior, or transactions. As a result, insurers may struggle to identify and address payment issues promptly.

3. Delinquency

Managing overdue premiums can be resource-intensive and can increase the administrative costs linked with managing delinquent accounts. This also leads to a loss of revenue due to unpaid premiums and impacts cash flow.

These can lead to delayed premium collection, increased customer dissatisfaction, and potential revenue loss.

5 Key Strategies for Optimizing Premium Collection

To optimize premium collection, insurance companies can consider the following strategies:

1. Implementing Digital Payment Solutions for the Premium Collection

To optimize premium collection, insurance companies must embrace digital payment solutions and offer secure online payment options to allow policyholders to pay their premiums conveniently anytime, anywhere, using their preferred payment method. This helps:

- Eliminate the need for physical checks or cash

- Reduce processing time

- Minimize administrative costs

2. Deploy Automation for Premium Collection

Automation is one of the key enablers for optimizing premium collection processes in the insurance sector. By automating routine tasks and workflows, insurance companies can streamline their operations and focus on critical tasks or cases that require personalized attention. This helps boost customer service and ensure collection success.

For this, insurance companies can follow these tips:

- Automate billing systems to send invoices to customers automatically and electronically with payment options

- Allow customers to set up recurring payments and allow them to schedule automatic deductions from their bank or credit cards to reduce the risk of missed payments

- Set up payment reminders via email, SMS, or automated calls

- Deploy an automated fraud detection system to identify suspicious or fraudulent premium payments

3. Streamline Delinquency Management

Collecting insurance premiums on time can be challenging for insurers. However, it’s critical to maintain healthy financial status and ensure policyholders are covered for the protection they have paid for. To streamline delinquency management and ensure smooth cash flow, insurers can follow these tips:

- Communicate early with your customers and before they become delinquent

- Provide flexible payment options or payment plans

4. Leverage Data Analytics and Monitoring

Insurance companies need to adopt a data-driven approach to optimize premium collection. By analyzing and monitoring payment patterns, customer behavior, transactions, and other relevant data, insurers can gain invaluable insights into payment trends and identify potential risks as well as gaps.

Continuous monitoring and evaluation of premium collection processes also help minimize revenue leakage, identify areas for improvement, and implement necessary changes to improve the overall collection process.

For example, real-time transaction tracking and reporting can enable insurers to monitor payment status and address any payment issues promptly, such as declined transactions.

5. Continuous Workforce Training and Upskilling

Train your staff with a focus on empathy and problem-solving skills to grow their knowledge base and handle delinquency effectively. Training and upskilling are also important to ensure employees, agents, and brokers understand the legal aspects of the premium collection and grace periods.

Insurers can provide the following training or initiate upskilling programs to effectively reduce delinquency in the insurance and optimize the premium collection process:

- Communication skills to ensure a clear, empathetic, and informative interaction with policyholders

- Compliance and regulatory knowledge to reduce the risk of disputes or compliance issues

- Fraud detection skills to recognize potential fraud activities related to premium payments

- Data analytical skills to identify trends and patterns to address delinquency issues

This also provides a sense of value to the employees as they feel the company is investing in them and teaching them new skills and abilities that will make them better. As a result, they feel more productive and improve their workplace capabilities.

Conclusion

Optimizing premium collection strategies is crucial for insurance companies to build profitable operations. By offering convenient and secure digital payment options, leveraging data analytics, and streamlining processes through automation, insurers can enhance collection efficiency, reduce administrative costs, and improve customer satisfaction.

By addressing the challenges in premium collection, such as delinquency, insurance companies can optimize their premium collection process and ensure a smooth cash flow for long-term success.

Want to learn more about optimizing premium collection strategies and how they can benefit your insurance operations? Contact us today for a consultation at: info@anaptyss.com.