Financial reconciliation is a crucial accounting process where a company's books are audited against bank statements to ensure accuracy and detect discrepancies or fraud. This blog discusses the types, importance, and challenges of reconciliation in banking. Anaptyss offers advanced solutions to optimize this process, enhancing accuracy, fraud detection, and compliance.

Financial reconciliation is a fundamental process in accounting, which involves auditing a company’s books or general ledger and tallying them against the associated bank statements to ensure the records match.

The process involves comparing the cash earned or spent and ensuring that every cent associated with checks, deposits, withdrawals, and other instruments during a fiscal year is well-documented.

Financial reconciliation aims to find discrepancies in the organization’s records and detect potential frauds and thefts from the bank account.

Failing to reconcile records or letting them go unchecked can lead to financial losses and allow fraudsters to continue their exploits.

This blog shares helpful information about the reconciliation process in banking, its types, importance, and challenges. It can help banks strengthen their processes, mitigate fraud and theft, and comply with regulatory standards,

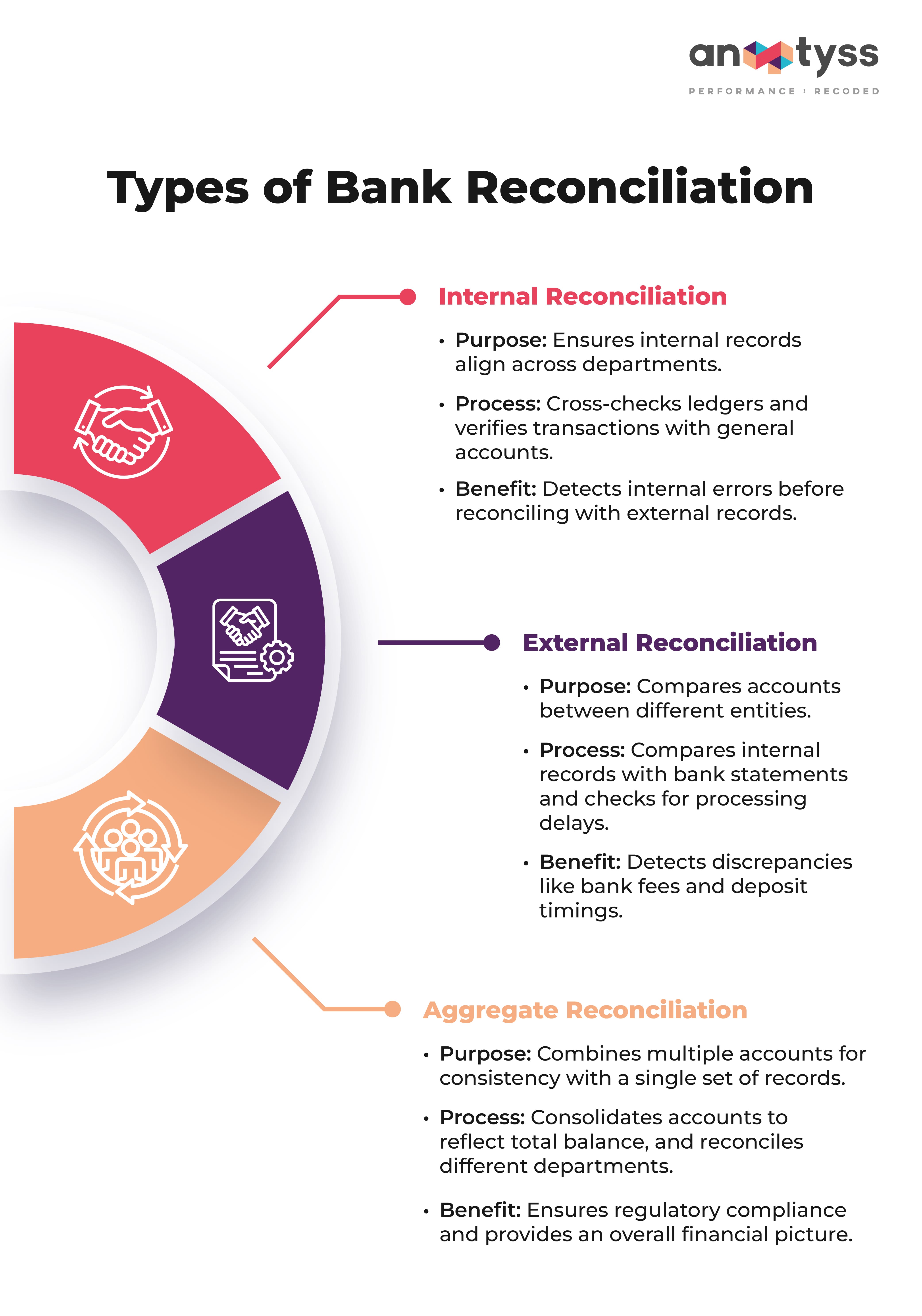

Types of Bank Reconciliation

Learn how one US-based community bank achieved transparent and real-time tracking of reconciliation tasks using Power BI in this success story.

There are three types of bank reconciliation, and each plays a distinctive role in financial management and auditing. These include:

1. Internal Reconciliation

Internal reconciliation is the process of comparing a bank’s records maintained across its departments to ensure they are accurate and reconciled with each other. The process involves:

- Cross-checking ledgers, such as matching transactions in sales ledger with cash receipt journal.

- Verifying the detailed records of individual transactions with general accounts or broader financial records.

These actions help identify and detect errors within the internal accounting system before tallying the records with external documents or entities.

2. External Reconciliation

External reconciliation compares accounts between different entities, such as the organization or business and its bank, or between two businesses. It involves

- Comparing the internal records with bank statements

- Identifying time differences, as some transactions may not reflect in the statement due to processing delays.

External reconciliation identifies discrepancies due to factors, such as bank fees, check issues, or deposit timings. It also helps ensure that cash balance records are consistent in the institutions’ accounting system with those reported in the statements.

3. Aggregate Reconciliation

This involves combining multiple accounts and verifying them against a single set of records or documents to ensure their collective accuracy. It is used to:

- Consolidate multiple accounts to reflect the total balance correctly

- Reconcile various sectors or departments to ensure their reporting accuracy and consistency.

Aggregate reconciliation helps the bank or financial institution to comply with regulatory requirements, such as SOX. It also provides a comprehensive overview of the financial status and avoids discrepancies in overall accounts.

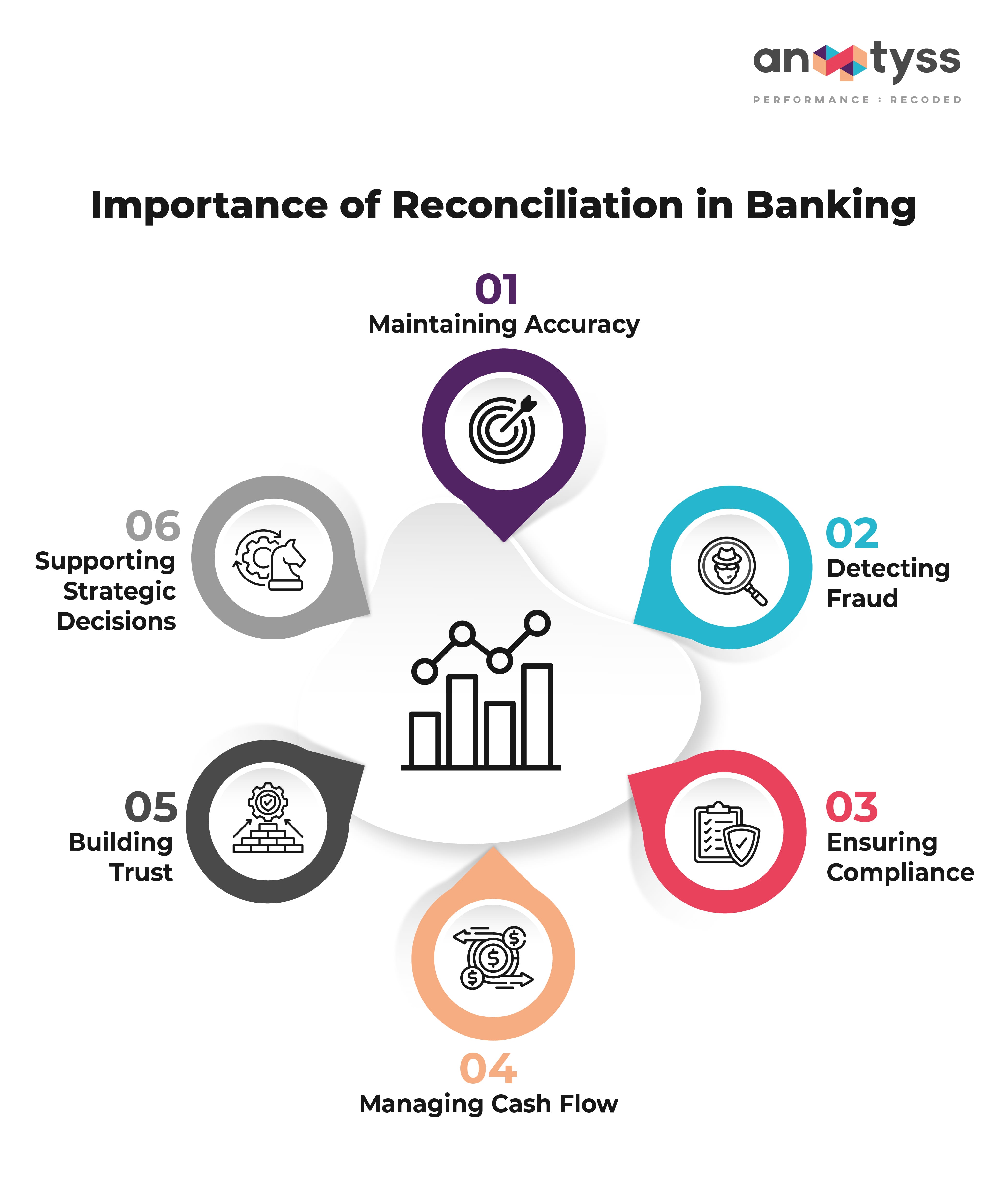

Importance of Reconciliation in Banking

Reconciliation in banking is a critical accounting task and mechanism for the financial integrity of the bank or financial institution. This process is essential for several reasons such as:

- Maintaining the accuracy of financial records by detecting errors made by the bank or the business’s accounting team and taking necessary actions to adjust them in financial records to reflect accurate transaction details.

- Regular reconciliation helps financial institutions detect unauthorized or fraudulent transactions and prevent such instances from reoccurring by implementing risk controls and security measures.

- Ensure compliance and audit readiness through verified and accurate financial records.

- Manage cash flows, as it provides an accurate picture of available funds that banks can use to manage their liquidity effectively for making better investment decisions.

- Transparent and regular reconciliation helps build trust among all stakeholders and enhances reputation in the market.

- Accurate financial information leads to better strategic decisions related to resource allocation, investments, risk management, etc., improving operational efficiency.

Challenges in Optimizing the Reconciliation Process in Banks and Financial Institutions

When it comes to optimizing the reconciliation process, financial institutions face several challenges. These include:

1. Data Management

Managing and processing vast amounts of data pose a primary challenge for banks and financial. This data includes transactions from multiple sources, such as credit card sales, online transactions, cash payments, and other payments. The complexity is further increased by the differences in transaction details between the bank statements and books (general ledgers) that make matching transactions more difficult.

2. Timing Difference

The time difference between the transactions recorded in the internal system and their records in the bank statement leads to mismatches. This is especially true about transactions involving credit cards and checks that may not be processed immediately by the bank and are prone to delay due to processing time.

3. Manual Processes

Most financial institutions, especially small and mid-sized banks, still rely on manual processes for bank reconciliation. However, these manual processes are prone to human errors. Manual entry of data, adjustments, and verification steps can lead to inaccuracies and inconsistencies that could be costly to rectify and time-consuming.

Automation can significantly reduce these risks—discover how digital-led transformation is streamlining banking operations.

4. Inadequate Oversight

Lack or inadequate oversight, monitoring, and manual handling of reconciliation processes can increase the risk of fraud. Employees handling the reconciliation may manipulate the data or hide it to cover fraudulent activities or theft.

5. Documentation

Maintaining accurate records for audits and compliance is a huge challenge for banks and financial institutions. With such a vast amount of transaction data, ensuring a well-documented and transparent reconciliation process to meet regulatory requirements and support internal/external audits becomes challenging.

6. Technology Integration

Integrating new and emerging technologies with existing systems and manual processes can be challenging. However, it is necessary to automate and optimize the reconciliation process. A lack of technical expertise and experience can make it more challenging to implement technology without violating regulatory norms.

Conclusion

Banks and financial institutions face numerous challenges in optimizing the bank reconciliation process, such as data management, time difference issues, manual process errors, and meeting compliance.

Anaptyss offers advanced digital solutions that can help overcome these obstacles. Some examples include automation of reconciliation tasks, improvement in accuracy, enhanced fraud detection, and regulatory compliance.

To see this in action, explore how we enabled faster and accurate real-time business reporting for a leading US bank using Power BI.

To know more, reach us at info@anaptyss.com