Explore the five strategic AML and blockchain trends shaping 2026, from regulatory harmonization and Agentic AI to cross-chain monitoring, stablecoin oversight, and pragmatic privacy with zero-knowledge proofs. Stay ahead in crypto compliance and financial crime prevention.

As the years go by and the global financial system matures into the year 2026, the digital asset sector has completely shifted from being an experimental sector into what analysts predict as the “Great Normalization”.

According to financial institutions (FIs), fintechs, and Virtual Asset Service Providers (VASPs), regulatory ambiguity is mostly gone. The ecosystem has been restructured by the law enforcement agencies, alongside the stablecoins that have been integrated into the core banking system, and the implementation of fully autonomous AI technologies that have been completed at a high speed.

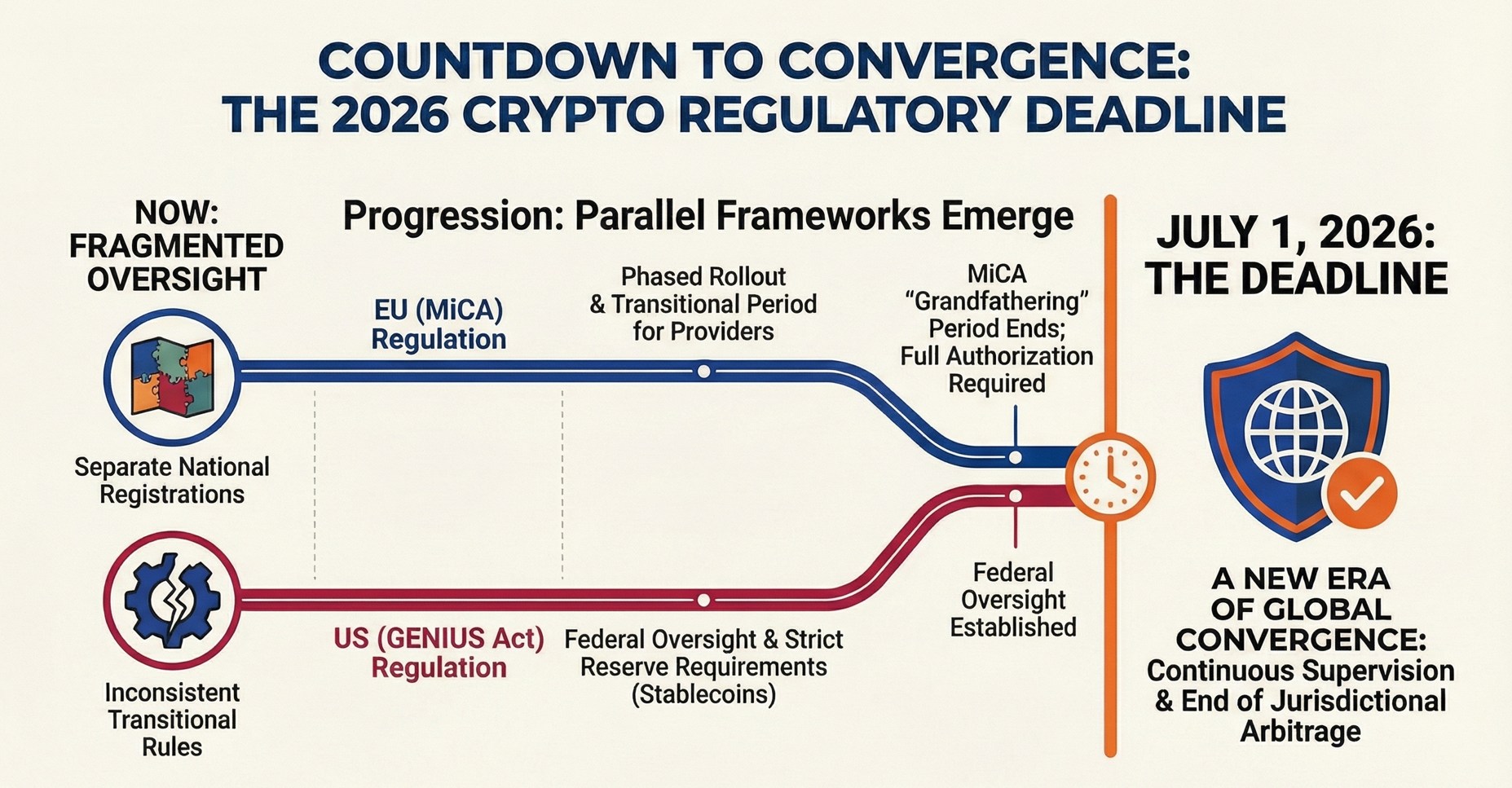

For compliance leaders, 2026 marks a critical point. The conjunction of the EU’s Markets in Crypto-Assets (MiCA) regulation, the U.S. GENIUS Act, and the increasing sophistication of financial crimes is the basis for the transformation from being reactive to proactive ecosystem governance.

In this blog, we outline five strategic AML and financial crime trends that will define the crypto and blockchain compliance landscape in 2026.

1. Regulatory Synchronization and The End of “Grandfathering”

The period of time known as transitional grace that has permitted various VASPs to function under limited national registrations is announcing its end. In Europe, July 1, 2026, will mean the complete end of the “grandfathering” clause only under MiCA. Therefore, from this time forth, any crypto-asset service provider that wishes to function in the EU will have to go through the full authorization process, resulting in the regulatory movement from onboarding to activity, supervision that is active and intrusive.

On the other hand, the United States is experiencing a new era of federal stability that is attributed to the implementation of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. One of the key points of this legislation is that stablecoin issuers are required to hold reserves in assets that are considered to be high-quality liquid such as the U.S. Treasury, and also they are under direct federal supervision.

As a result, the compliance bar has been raised significantly. Organizations can no longer choose to make use of jurisdictional arbitrage. By the year of 2026, the inadequacies in the regulations of one area may solidly be the reason for some, if not all, areas exacerbating the problem, which will be the cause for the urgent need of uniform, cross-border regulatory regimes.

2. The Rise of “Agentic AI” vs. The Explainability Imperative

By the year 2026, the use of Artificial Intelligence in Anti-Money Laundering will not be limited to just identifying problematic transactions but it will also enable the full functioning of the process. The industry is seeing the growth of Agentic AI, where systems are created that can facilitate several job roles, from the first stage of alert triage to the evidence packaging for SARs, all without the involvement of a human.

While these autonomous agents are incredibly powerful—capable of ingesting multimodal evidence, correlating access logs, and proposing mitigation actions to drastically cut down the “mean time to insight”—there is a massive catch called Explainability.

If you look at the recent guidance coming out of the European Banking Authority (EBA) and NIST, the message is loud and clear. The era of the “black box” AI is effectively over. By the time we get deep into 2026, institutions won’t just need to make the right decisions; they will need to prove how they made them. Efficiency is great, but it cannot come at the cost of auditability.

3. Closing the “Cross-Chain” Blind Spot

Criminal methodologies have evolved faster than legacy monitoring tools. The primary tactic for illicit finance in 2026 is “chain-hopping”—moving funds rapidly across incompatible blockchains to break the transaction trail.

Legacy AML systems that provide only “fragmented snapshots” of a single blockchain are now considered operational risks. Analysis reveals that over 1.46 billion in a single year.

To remain compliant in 2026, firms must deploy forensic tools capable of Entity Resolution (ER)—using graph analytics to visualize and trace funds across 50+ blockchains and hundreds of bridges simultaneously.

4. Stablecoins: The New Rails of Institutional Finance

Stablecoins have become the primary entry point for institutional adoption. We are seeing a decoupling where Bitcoin creates its own “white space” as a store of value, while blockchain assets supporting tokenization and stablecoins drive utility in financial markets.

Despite this utility, stablecoins represent a high concentration of financial crime risk. Illicit volumes involving stablecoins and decentralized finance continue to rise, with fraud and scams accounting for an estimated $51 billion in on-chain activity.

The Financial Action Task Force (FATF) notes that most on-chain illicit activity now involves stablecoins. Consequently, “gold-standard” compliance in 2026 requires integrating treasury data with blockchain analytics to create real-time dashboards that demonstrate reserve coverage and token supply to regulators.

5. Pragmatic Privacy via Zero-Knowledge Proofs

A profound shift occurring in 2026 is the move toward “pragmatic privacy.” Institutional investors require confidentiality to prevent front-running of their strategies, yet they must satisfy strict AML/KYC mandates.

The solution gaining traction is Zero-Knowledge Proofs (ZKPs). ZKPs allow institutions to prove compliance—such as verifying a user is not from a sanctioned jurisdiction or meets accreditation standards—without revealing sensitive underlying data to the public blockchain. This technology is becoming a cornerstone for B2B crypto payments and payroll platforms, balancing the “privacy-compliance paradox.”

Conclusion

As we navigate 2026, the boundary between cybersecurity and AML compliance has largely disappeared. Attackers now focus on identity theft and “signing in as a real user,” making identity protection a frontline AML control.

The winners in this new landscape will be financial institutions and banks that treat compliance not as a cost center, but as a prerequisite for market integrity and institutional partnership. Success requires modernizing data architectures to support Agentic AI, ensuring human-in-the-loop oversight for explainability, and preparing for a world where digital assets are fully integrated into the global financial core.

Anaptyss helps banks, financial institutions, and digital asset firms build scalable, regulator-ready AML and financial crime compliance capabilities across crypto and blockchain ecosystems.

To learn more, contact us at info@anaptyss.com.