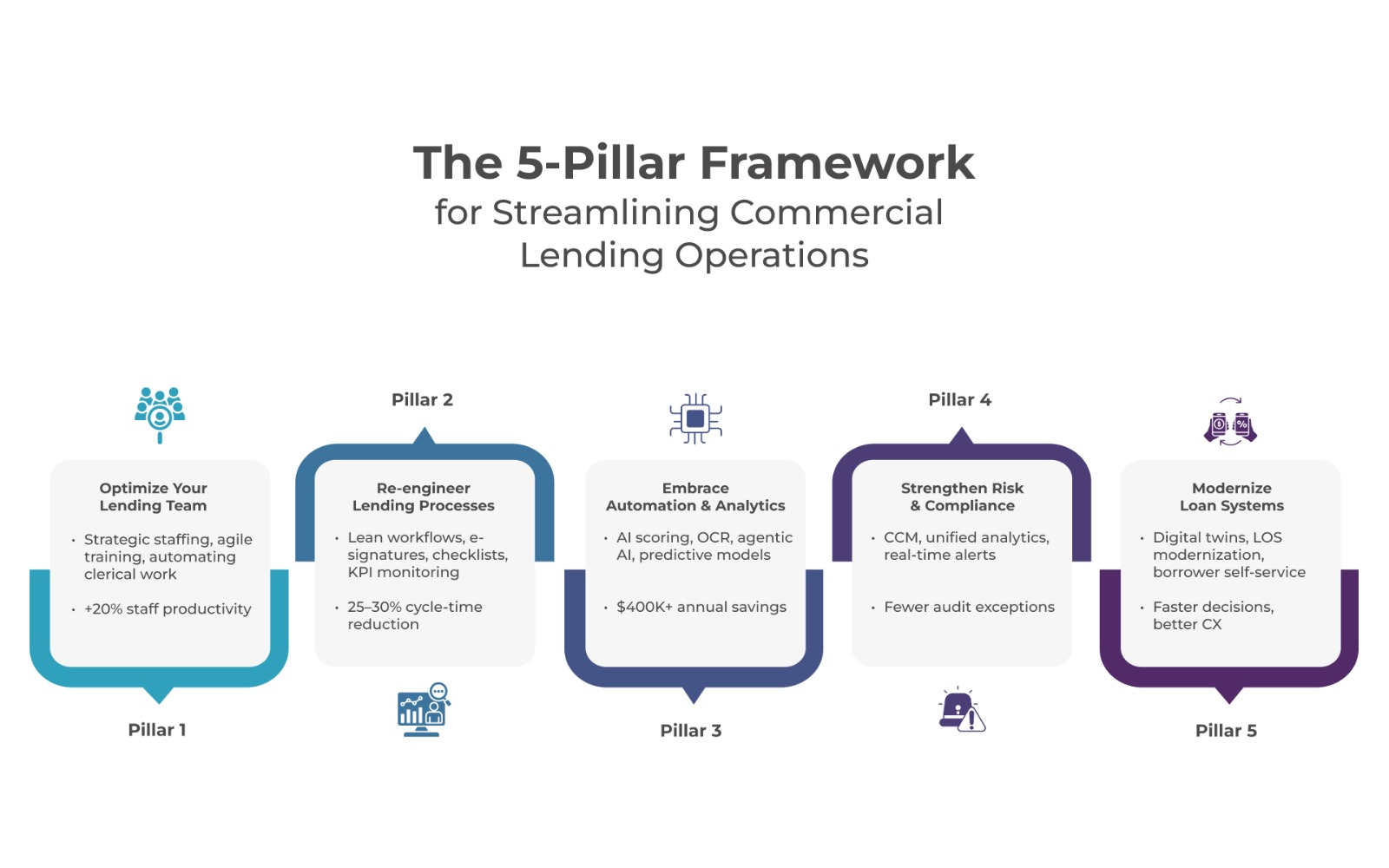

Discover five actionable strategies to enhance your commercial lending workflow. Learn how banks can optimize staffing, automate processes, and leverage AI to drive efficiency, compliance, and borrower satisfaction.

Commercial lending is inherently complex— involving multiple stakeholders, complex documentation, risk evaluations, regulatory oversight, and ongoing portfolio monitoring. Many regional and community banks still rely on high manual workloads, paper‑based steps, fragmented/siloed systems, and repetitive checks, which slow decision cycles, increase costs, and frustrate borrowers.

According to a recent BCG report, standardizing and simplifying processes can unlock up to 30% gains in efficiency in corporate lending operations. A joint Nasdaq-BCG study estimates that banks could free up USD $25–$50 billion annually by reducing complexity in compliance and operations.

In this blog, we outline five strategies that banks and lending institutions can adopt to streamline their lending operations and meet borrower expectations for speed and transparency.

1. Optimize Your Lending Team (Staffing & Training)

Misaligned staffing models—from duplicated roles to fragmented handoffs—are a major drag on throughput.

Start by evaluating your current workforce against future needs. Conduct a skills inventory and identify critical positions, e.g. relationship managers, commercial lenders, credit analysts, underwriters, compliance officers and operations staff. A well-designed staffing plan anticipates loan volume trends and regulatory demands, ensuring the right mix of expertise is in place.

It’s also crucial to build agile training programs to close skill gaps. For example, use digital learning platforms to provide workforce training where it’s needed most. Online modules, mentoring and cross‑training can make staff more productive (and satisfied) in new roles.

In today’s market, many banks hire candidates with a “growth mindset” – people eager to learn – and train them internally, rather than insisting on years of experience. Robust in‑house development helps retain talent and creates a culture of continuous improvement.

Further, it’s equally critical to free the team to focus on value‑add and strategic tasks by automating or outsourcing mundane or routine work. For instance, banks report that loan officers often spend ~30% of their time on clerical tasks like gathering financial statements and data entry. Mapping out and eliminating these “paper jams” allows officers to spend more time on client relationships and credit analysis. This not only speeds origination but also helps recruit and retain bankers – employees are likelier to stay when they feel their work is meaningful and productive.

2. Re-engineer Lending Processes with Lean Design

Complex, nonstandard paths and many decision touchpoints cause bottlenecks. BCG highlights that applying standardization and “fast lanes” (by risk or size) can deliver up to 20%-30% process gains.

Document every step of the lending process (from application intake through underwriting, approval and funding) to spot bottlenecks. Whiteboarding or flowcharting reveals where paper, hand‑offs or delays occur. Once mapped, set firm standards.

For example, use checklists for required documents and define clear hand-off points between teams.

Also, adopt continuous improvement methods to remove waste. Focus on activities that add value (such as thorough borrower analysis) and eliminate unnecessary steps. Use simple metrics (cycle times, approval rates, error rates) to measure each stage. By regularly reviewing these metrics, managers can pinpoint delays (e.g. slow credit committee decisions) and take corrective action.

Similarly, it’s also important to replace manual processes with digital ones – whenever possible. For example,

- Shift from paper applications and physical file rooms to a centralized loan‑origination system that routes tasks automatically.

- Electronic checklists and auto‑generated documents ensure consistency.

- Embedding e‑signature for agreements and automated funding disbursements can cut days from the closing process.

For institutions aiming to future-proof their credit function, our white paper on Credit Portfolio Management in an Era of Fluctuating Interest Rates outlines how data-driven portfolio monitoring enhances resilience amid market volatility.

3. Adopt and Leverage Automation and Advanced Analytics

Data-driven lending is no longer optional. Banks that leverage predictive analytics, sentiment modeling, and behavioral scoring can better evaluate borrower risk, anticipate defaults, and tailor credit structures.

According to AI adoption studies, banks implementing AI in commercial lending may realize productivity gains of 20–60%.

In our success story on ML-based credit risk scoring, a regional bank achieved over $400K annual savings by adopting machine learning models that improved credit accuracy and reduced manual rework. Use data to tailor lending solutions and communication. Advanced analytics can suggest optimal loan structures or cross-sale opportunities based on customer profiles. By making data backed recommendations, bankers can enhance client relationships and close deals more efficiently.

Other use cases includes –

- Intelligent document capture / OCR to Auto-extract financials and reports from scanned documents, cross-check consistency, reduce data entry.

- Decision support + scoring engines by using predictive models to flag credit risk anomalies, generate summary insights, or estimate pricing.

- Agentic AI & workflow agents that act autonomously within guardrails for routine credit tasks (e.g., reviewing covenants). Insights from Reimagining Banking Functions with Generative and Agentic AI demonstrate how emerging technologies can elevate credit operations and customer experience.

For institutions aiming to future-proof their credit function, our white paper on Credit Portfolio Management in an Era of Fluctuating Interest Rates outlines how data-driven portfolio monitoring enhances resilience amid market volatility.

4. Strengthen Compliance and Operational Risk Controls

In the current regulatory climate, effective lending operations require robust control frameworks, continuous monitoring, and risk-based oversight. Banks can adopt continuous controls monitoring (CCM) frameworks to detect anomalies in real-time and ensure consistent compliance. Our white paper on Continuous Controls Monitoring in Banking explains how automation-driven monitoring helps institutions mitigate cybersecurity, compliance, and operational risks while maintaining transparency.

Break down silos so that all loan data (applicant info, collateral values, credit decisions, repayments) flows into one analytics platform. With integrated data, it becomes easier for the banks to track key metrics, such as turnaround times, pipeline volume, loss rates and spot trends early — for example, a rise in loan defaults in a particular industry.

5. Modernize Loan Systems with Emerging Technologies

The future of commercial lending lies in integrating AI, digital twins, and intelligent process automation to create adaptive, insight-driven ecosystems. From document intelligence that auto-classifies borrower data to agentic AI that simulates credit risk outcomes, these technologies are transforming how loans are processed and monitored.

Our white paper on Leveraging Digital Twins for Model Risk in Banking showcases how digital twin frameworks enhance transparency and stress testing for credit portfolios.

Empower customers with online capabilities. Let them upload financial statements via secure portals, sign documents electronically, and even initiate collateral checks or appraisal orders digitally. Digital platforms can automatically notify clients when documents are received or a deal advances to credit review.

But remember the most important element – human touchpoints. Identify critical moments for human contact. For example, automate routine renewals but schedule a check‑in call for larger loans. Personalizing critical interactions (credit pulls, committee briefings, loan closings) can build trust. In practice, some lenders are training loan officers to act more like financial advisors – using the time saved by automation to offer deeper strategic advice on borrowers’ needs.

Conclusion

By combining these strategies – a well‑trained team, lean processes, smart tech and rich data – banks can dramatically speed up commercial lending while controlling risk.

At Anaptyss, we partner with financial institutions to architect end-to-end, domain-led transformations in credit, lending, risk, and operations. Our frameworks and accelerators deliver measurable impact across efficiency, cost, and control.

To learn how we can help you elevate your commercial lending operations, reach use at info@anaptyss.com.