The blog explores the role of managed services in delivering financial services, industry challenges, and key benefits of having a strategic partner for managed services in banking.

In the digital-first world, the financial services industry is constantly evolving, navigating the unpredictable economic and regulatory landscape driven by the need to streamline operations and increase productivity.

To compete and stay ahead in the market, financial institutions are increasingly considering the managed services model to better organize, operate, and safeguard their business.

Managed services are different from the traditional outsourcing that banks, up until now, relied on to maximize their resource efficiency. Managed services provide a range of solutions and services that help financial institutions better optimize their operations, drive growth, and accelerate digital transformation in this unpredictable fast-paced environment.

6 Key Challenges in the Financial Services Industry

The financial services industry operates in a complex and highly regulated environment, facing numerous challenges that are unique to their line of business. Some of the key challenges include:

1. Need for Scalable Operations and Delivery Capacity

At times, financial institutions may need the capacity to serve higher volumes of customer requests and transactions. As demand increases in the market, banks and financial institutions often struggle to find and hire skilled employees quickly to meet the rising workloads.

This shortage of talent pool and skilled workforce to meet the rising demands also puts a strain on existing resources. As a result, it can divert attention from core banking functions, digitization initiatives, and innovation.

2. Maintaining Operational Efficiency and Throughput

As the customer base increases, banks need to deploy their in-house employees to support the increased workload and influx of larger transaction volumes to ensure consistency in their services. This increases overheads and inefficiencies leading to downtime, slower response rates, bottlenecks, and errors. The situation can impact quality and lead to risks.

3. Regulatory Compliance in an Emerging Landscape

To stay compliant with the constantly evolving regulatory compliance, laws, industry standards, etc., requires extensive monitoring. However, when customer interaction and transactions increase with the rise in demand, it can potentially lead to compliance gaps and hefty penalties.

4. Effective Adoption of Technology

Many banks and financial institutions are still running on legacy systems and have been slow in adopting digital solutions. They often struggle when it comes to introducing or implementing new technologies hampering their ability to gear up for transforming their capabilities. This could be due to a variety of reasons, such as

- Data security concerns

- Lack of technical expertise

- Regulatory compliance and more

5. Employee Onboarding, Training, and Upskilling

Continuous employee training and upskilling are crucial for engaging talent and building operational expertise. However, banks often encounter resource constraints in terms of logistics, time, and costs. In addition, the following are also some major challenges that banks encounter when it comes to onboarding, training, and skilling workforce:

- Lack of in-house expertise to design and develop a comprehensive training program

- Limited accessibility due to traditional training methods leads to insufficiencies in catering to remote and geographically dispersed staff

- Engaging a diverse workforce with varying skills requires a tailored training approach

The U.S. Chamber of Commerce Foundation reported that 74% of hiring managers in the United States faced difficulty finding skilled candidates for their job openings in 2019.

6. Business Continuity

Business continuity in banks and financial institutions may be affected due to several factors, including regulatory violations, cybersecurity threats, staffing demands due to a sudden rise in market demand, IT failures, geopolitical events, etc.

Lack of a comprehensive and documented recovery plan, inadequate backups, system or network vulnerabilities, insufficient technology infrastructure, etc., can hinder the restoration after a disruption, leading to extended downtime, and risk of non-compliance, and reputational and financial loss.

These challenges can overwhelm banks and financial institutions, especially SMEs, and can hinder their productivity and growth. With managed services, financial institutions can receive expert and timely support and specialized services to overcome these obstacles.

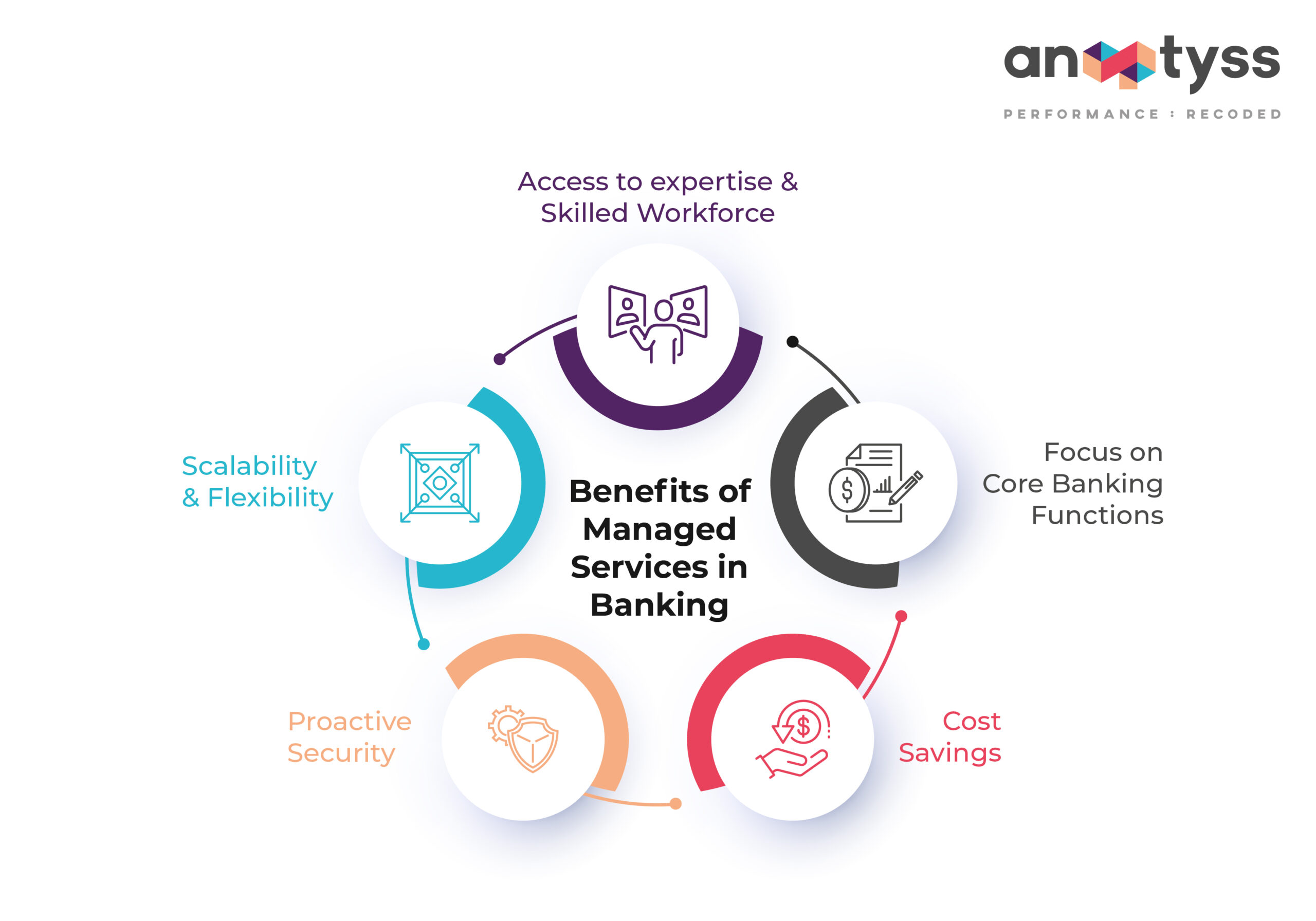

5 Key Benefits of the Managed Services Model in the Financial Services Industry

A strategic partnership with a managed services provider can go a long way and help the financial services industry transform, run business operations and processes, and improve operational quality and efficiency. Particularly the people, processes, and locations, which are expensive to maintain.

Managed service partners leverage emerging technologies such as artificial intelligence, machine learning, and automation to streamline redundant processes and eliminate manual tasks. For instance, robotic process automation (RPA) can automate repetitive and rule-based processes. This can further

- Reduce errors and improve accuracy

- Speedup the operations

- Achieve faster processing times

- Ensure greater transparency and operational efficiency

By outsourcing most of the non-core functions to the managed services provider, financial institutions can effectively allocate their in-house resources to focus on value-added activities and innovation.

In addition, managed services in the financial services industry offer the following key benefits:

1. Access to Expertise

Managed services providers bring a wealth of industry knowledge and expertise to the table that enables financial institutions to tap into specialized skills and best practices. A strategic partner can help financial institutions improve their operational efficiency and customer experience by:

- Bringing industry-specific expertise

- Expertise in digital technologies such as Robotic Process Automation and intelligent document indexing

- Built-in quality assurance and compliance

- Scalability and flexibility to support global delivery

This expertise also allows banks and financial institutions:

- Drive innovation

- Improve operational efficiency

- Ensure compliance with industry regulations

Also, the solutions and expertise provided are customized to the banks’ specific needs with global consistency.

2. Access to Specialized and Global Talent Pool

Financial institutions can have ready access to a specialized global talent pool and a wider range of potential candidates for recruitment for delivering specific processes. In addition, they:

- Bring their domain expertise along with an extensive network of skilled professionals

- Connect the institutions with qualified candidates who possess the necessary skills and experience

They also leverage the best practices in talent retention and provide valuable market insights, such as the latest industry trends, salary ranges, etc. to help mortgage institutions make informed decisions related to talent acquisition and retention.

A survey by Deloitte found that 44% of financial services organizations, including the mortgage sector, experienced difficulty recruiting and retaining skilled professionals.

Suggested Read: Unleashing Growth with “Right- shoring” Model

3. Improved Scalability and Flexibility

Managed services offer the flexibility to scale operations up or down based on demand, allowing organizations to respond quickly to market fluctuations or changing market conditions while ensuring profits.

They can help banks meet the sudden rise in staffing, resources, and infrastructure challenges, especially concerning the hiring, onboarding, and training of high-quality talent.

This scalability ensures that financial institutions can meet customer needs effectively, without the risk of over or under-investment.

4. Regulatory Reporting and Compliance

When it comes to dealing with regulatory reporting, banks may find themselves struggling to keep up with an ever-changing regulatory landscape with constantly evolving rules and requirements. This is where managed services step in to make things easier for financial institutions.

They provide experts from the industry who understand the intricacies of the regulations and reporting standards. They help them collect and organize the necessary data for accurate and timely reporting, which is crucial to avoid penalties, reputational loss, and trouble with regulatory bodies.

A study by Robert Half reported that 42% of finance executives found it challenging to recruit skilled professionals with regulatory compliance expertise.

They also help banks stay up-to-date with regulatory changes and ensure banks remain compliant with the latest standards.

5. More Than Cost Savings

Partnering with a managed service provider isn’t just about cost savings associated with labor, infrastructure, and technology investments; it’s a strategic investment with the array of benefits we mentioned above. Managed services providers often operate at scale, allowing financial institutions to benefit from economies of scale and access specialized expertise, which is too expensive and time-consuming to build in-house. Financial institutions can also capitalize on the predictable outcome-based pricing models with reduced exposure to financial risks.

Managed Services – Success Stories

To learn more about the transformative power of managed services in the financial services industry, read the following case studies that showcase successful implementations to address specific challenges faced by financial institutions and deliver tangible results in terms of efficiency, customer experience, and cost savings.

- Transformation of Treasury Management Operations and Efficiency Improvements for a US-Based Regional Bank

- US-Based Consulting Firm Attains 60% Faster Turnaround Through Agile Program Management and Business Analytics

Conclusion

Managed services can propel transformative innovation, elevate operational resilience, and help achieve regulatory excellence for banks and financial institutions. They provide expert support, scalable solutions, and advanced digital solutions to manage banks’ daily operations and enable them to focus on their core/strategic programs and innovation to enhance customer experiences and stay ahead of the competition.

Want to learn more about the managed services model? Connect with us: info@anaptyss.com.