This blog examines how banks can improve prepayment risk forecasting beyond simple interest rate models. Anaptyss introduces a four-factor approach that includes refinancing incentives, seasonality, loan age, and burnout effects. The article demonstrates the financial benefits of sophisticated modeling and provides practical implementation strategies for financial institutions.

Through extensive analysis and collaboration with banking and financial services institutions, Anaptyss has observed the significant challenges in accurately forecasting customer behavior, particularly regarding loan prepayments. When interest rates decline, conventional wisdom suggests an immediate surge in mortgage refinancing activity. However, empirical evidence indicates a considerably more nuanced reality.

This scenario repeats consistently across the financial sector. Management teams rely on prepayment models that project minimal portfolio disruption for upcoming quarters. Subsequently, when rates decline unexpectedly, institutions experience substantial early repayment volumes. This results in material compression of net interest margins and necessitates rapid strategic adjustments.

Analysis demonstrates that traditional prepayment modeling methodologies frequently fail to capture the multidimensional nature of borrower decision-making. While interest rate differentials constitute a primary factor, they represent merely one component within a complex framework of variables that influence credit risk management.

The Prepayment Risk Challenge

Financial institutions recognize that prepayment risk represents a significant concern for balance sheet management. When borrowers retire loans ahead of schedule, particularly fixed-rate instruments, this creates multiple adverse consequences:

- Revenue reduction: High-yielding assets originated in previous rate environments are replaced with new loans at potentially lower prevailing rates.

- Liquidity management complications: Unexpected cash inflows require reinvestment, often during suboptimal market conditions.

- Asset-liability duration misalignment: Carefully structured balance sheet duration profiles become compromised, potentially creating interest rate risk exposure during periods of heightened market volatility.

These factors explain the substantial institutional investment in developing sophisticated prepayment forecasting methodologies. As outlined in previous blog on operational risk management in financial services, effective risk modeling is essential for maintaining institutional stability.

The Four-Factor Model – Beyond Unidimensional Models

A common methodological limitation observed in the industry involves excessive focus on interest rate differential metrics. While the variance between a customer’s existing rate and available refinancing options constitutes a relevant factor, it fails to provide comprehensive predictive capability.

Anaptyss research has identified notable behavioral patterns contradicting conventional modeling assumptions. During certain periods characterized by declining interest rates, high-income borrowers frequently demonstrate refinancing activity substantially below model predictions. Analysis suggests these clientele segments place greater value on time efficiency than potential interest savings. The administrative requirements associated with refinancing often outweigh modest payment reductions for this demographic.

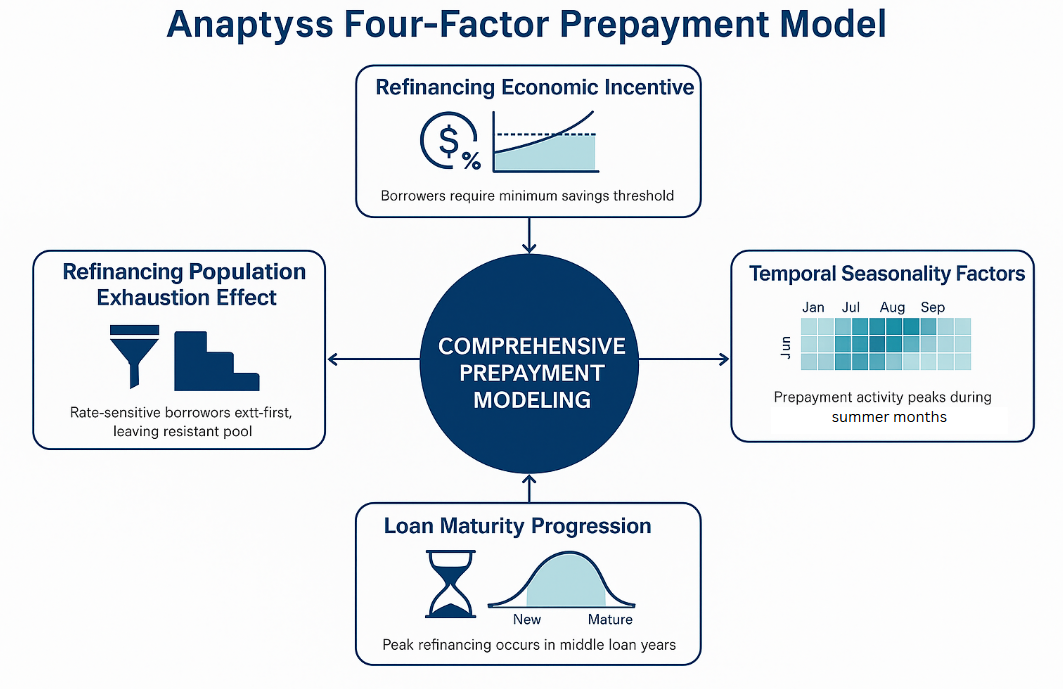

Based on extensive market research and validation, this multifactor modeling framework incorporates four critical components that align with top model risk management priorities for the banking industry.

- Refinancing Economic Incentive

Interest rate differential analysis requires contextual refinement. Research indicates threshold effects exist below which borrowers demonstrate minimal refinancing propensity despite positive economic incentives. - Temporal Seasonality Factors

Statistical analysis confirms borrowers execute major financial decisions with seasonal patterns. Anaptyss data demonstrates consistently elevated prepayment activity during summer periods relative to winter months, corresponding with residential mobility patterns and lifecycle transitions. - Loan Maturity Progression

Recently originated loans demonstrate minimal refinancing probability. As loans mature, prepayment likelihood follows a characteristic distribution curve, with peak activity during intermediate maturity phases and diminishing probability approaching final maturity. - Refinancing Population Exhaustion Effect

This phenomenon manifests following extended periods of refinancing opportunity, where rate-sensitive borrowers have previously exercised refinancing options, resulting in a remaining population demonstrating reduced sensitivity to subsequent rate declines.

Comprehensive modeling requires integrating these factors to achieve statistically valid prepayment behavior forecasting. This approach is consistent with proven methodologies as discussed in modern approaches to credit risk modeling and has demonstrated significant effectiveness in our machine learning-based credit risk scoring model implementation.

Measurable Benefits

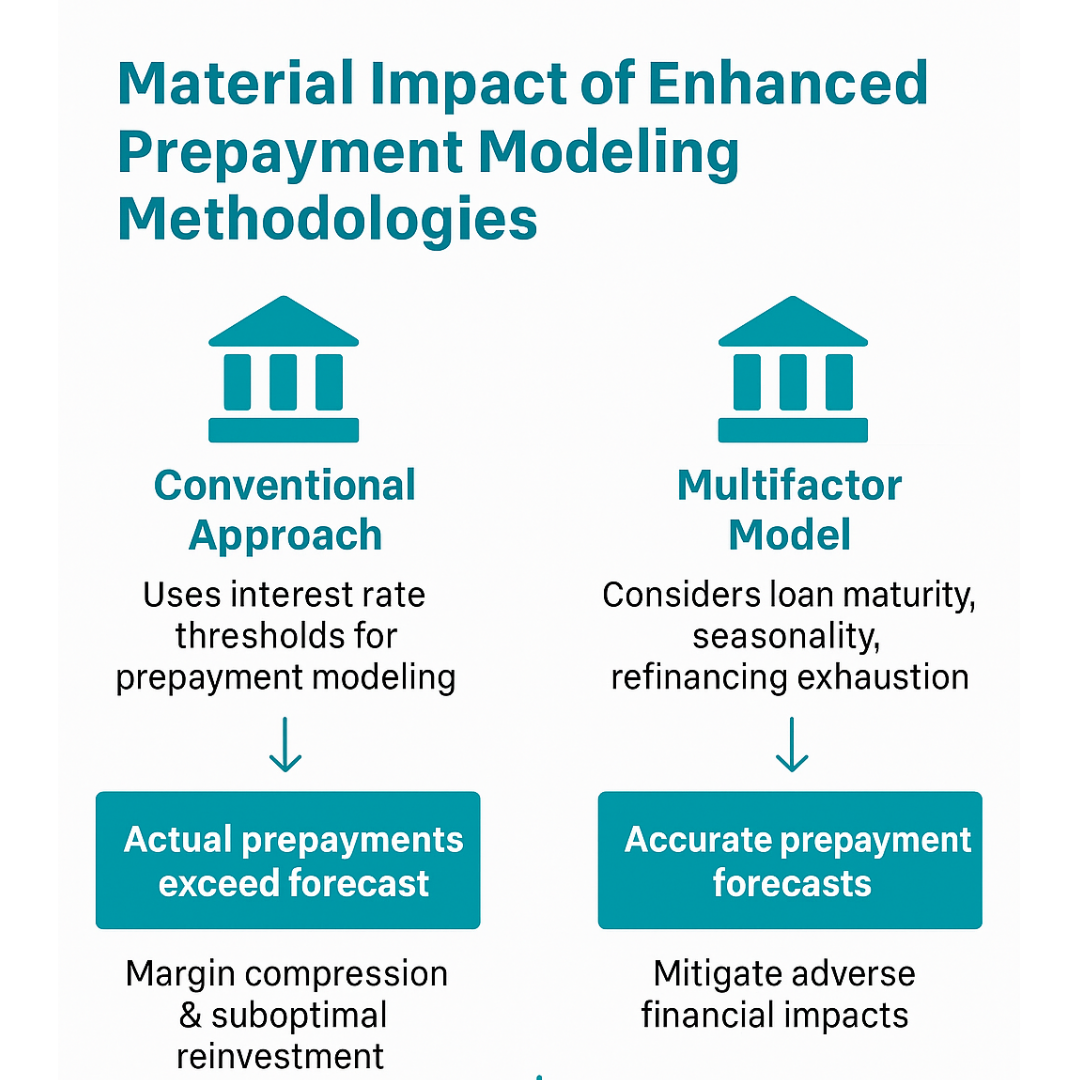

To illustrate the material impact of enhanced prepayment modeling methodologies, consider the following scenario.

An example,

Two equivalently sized regional banking institutions implement divergent approaches to prepayment risk management. The first utilizes conventional interest rate threshold methodologies, while the second implements a comprehensive multifactor model incorporating seasonal variations, loan maturity profiles, and refinancing exhaustion metrics.

During an unanticipated interest rate decline scenario, the first institution experiences actual prepayment volumes substantially exceeding forecasted levels. Consequently, they face significant margin compression and suboptimal reinvestment of excess liquidity in the prevailing low-yield environment.

Conversely, the second institution’s prepayment forecasts demonstrate significantly higher accuracy. This enables proactive balance sheet strategy adjustments, substantially mitigating adverse financial performance impacts.

This comparative analysis demonstrates that forecast accuracy differentials between robust and suboptimal prepayment modeling methodologies can generate material financial performance variance for institutions regardless of asset size. As demonstrated in our case study on portfolio model validation, advanced modeling techniques can improve validation efficiency by up to 40%.

Strategic Implementation Framework

For institutions seeking to enhance prepayment risk forecasting capabilities, it is recommended to implement the following strategic initiatives:

1. Implement statistically valid portfolio segmentation methodologies.

Effective analysis requires granular portfolio stratification. Develop segmentation frameworks incorporating parameters demonstrating statistical correlation with prepayment behavior, including product characteristics, demographic variables, loan amount distribution, and rate structure attributes. This approach aligns with our comprehensive framework for risk management in banking operations.

2. Conduct comprehensive historical pattern analysis beyond interest rate factors.

Execute detailed retrospective analysis examining seasonal prepayment patterns, maturity distribution effects, and historical refinancing opportunity periods. Sophisticated data mining techniques can identify valuable predictive relationships within existing institutional data. For examples of effective implementation, see our success story on fraud transaction detection capabilities.

3. Establish rigorous model governance protocols.

Model effectiveness deteriorates over time as market dynamics evolve. Implement systematic monitoring procedures comparing forecasted versus actual prepayment metrics, and develop recalibration methodologies responsive to evolving customer behavior patterns. In addition, the three lines of defense model for risk management provides a structured approach to ensuring ongoing model effectiveness.

Conclusion

While quantitative methodologies provide the foundation for effective prepayment modeling, it remains essential to incorporate behavioral finance perspectives. Ultimately, prepayment decisions represent individual financial determinations based on unique personal circumstances.

This recognition underscores Anaptyss’s methodological approach integrating quantitative analytical rigor with qualitative behavioral analysis when developing prepayment forecasting models. The numerical analysis provides necessary structure, but behavioral understanding provides essential context. Read the full white paper to dive deeper into our methodology.

Financial services fundamentally represent transactions between institutions and individuals. The most effective risk management frameworks maintain focus on this core relationship, as emphasized in our enterprise risk management framework for financial institutions.

To learn how we’re helping leading institutions improve accuracy, optimize balance sheets, and stay ahead of prepayment risk, reach out to us at info@anaptyss.com