Optimizing credit operations workflows is essential for financial institutions aiming to enhance efficiency, reduce risk, and improve customer satisfaction. This blog outlines seven strategic steps to transform outdated, manual credit processes into streamlined, tech-enabled workflows. From process assessment and automation to technology integration and performance monitoring, these insights offer actionable guidance to drive productivity and sustainable growth in credit management.

The efficiency of credit operations directly impacts a bank or lending institutions’ financial health and competitive edge. As a cornerstone of financial management, credit management workflows are undergoing significant evolution, shifting from traditional manual methods to sophisticated, technology-driven approaches. This transformation is a necessity for achieving sustainable growth and enhanced customer satisfaction.

In this blog, we discussed the seven essential strategies to optimize the credit operations workflow and shared insights that move beyond basic understanding to actionable implementation. For foundational insights on credit risk frameworks, read our blog on credit risk management best practices and processes.

1. Review Current Workflow Assessment Methodologies

Before embarking on any optimization journey, it’s crucial to take a hard, analytical look at your existing workflows. This involves meticulously documenting current processes to pinpoint bottlenecks, redundancies, and areas ripe for improvement. A highly effective methodology for this is process mapping, which offers a visual representation of every step in your workflow.

Key components of a comprehensive workflow diagram include:

- Activities – The specific tasks or operations performed.

- Decisions – Points where choices are made, often represented by a diamond shape.

- Flow – Arrows indicating the sequence of tasks.

- Roles – Who is responsible for each step.

Visual mapping helps identify inefficiencies and fosters better collaboration among team members, even those less technical. Advanced tools like process mining and intelligence can analyze event logs from your processes to automatically generate these visual representations, precisely highlighting the root causes of bottlenecks and inefficiencies. Learn more about the impact of process mining in our blog on how process mining improves financial operations.

2. Process Efficiency Improvements Through Automation

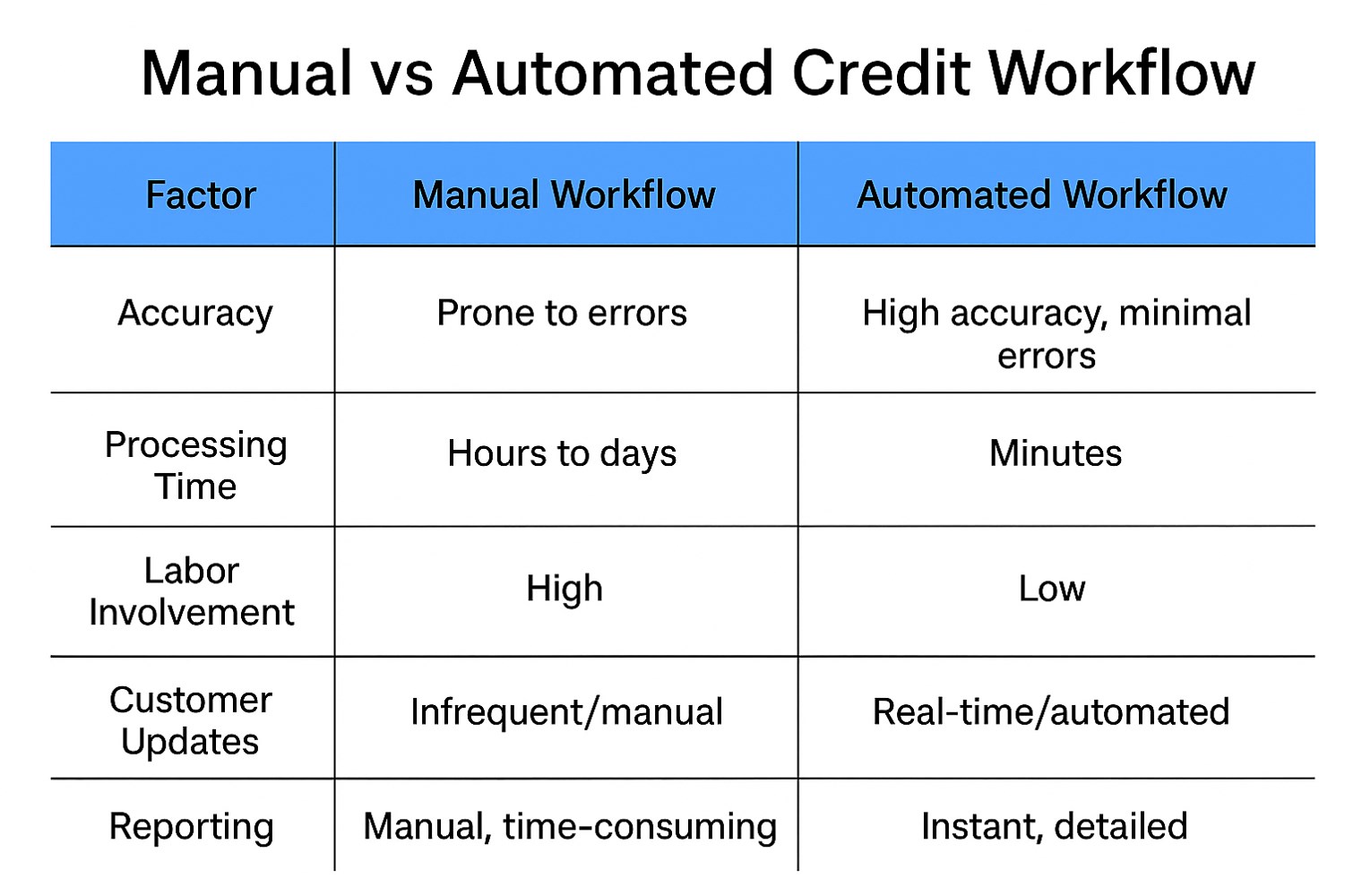

Automation stands as a significant game-changer in credit operations, addressing the inherent inefficiencies and error proneness of manual processes. Integrating workflow automation software reduces execution time, minimizes human error, and ensures tasks are completed consistently.

The benefits of embracing automation in credit management are manifold:

- Increased Accuracy – Eliminating manual errors leads to more accurate data and better decision-making, while also reducing operational costs.

- Faster Processing – Automating credit applications and approvals significantly accelerates turnaround times, improving customer satisfaction.

- Reduced Manual Labor & Time – By automating repetitive tasks like data entry, document generation, and compliance checks, staff can reallocate their efforts to more strategic, value-driven activities.

- Enhanced Reporting – Automated systems provide detailed reports on applications, approvals, and payment history, facilitating improved decision-making and identifying areas for further enhancement. For a closer look at automation’s role in credit workflows, explore how financial spreading services are transforming commercial lending workflows.

- Improved Communication – Digital workflows can provide real-time updates to customers on application and payment statuses, enhancing transparency and reducing inquiries.

3. Identify Bottlenecks and Resolution

Bottlenecks are those “pesky hiccups” that cap the overall efficiency of your operations, even if other processes are streamlined. Identifying these choke points is essential for maximizing business profitability and consistent efficiency.

Through thorough workflow documentation and process mapping, you can easily pinpoint redundant tasks and unnecessary steps that cause delays. Once identified, automation often provides the solution to fix these bottlenecks. Setting clear, actionable objectives from the start helps align your team to efficiently eliminate these obstacles.

4. Technology Integration for Workflow Enhancement

Modern credit management necessitates the adoption of cutting-edge technologies. Investing in specialized Loan Management Software (LMS) can streamline operations by automating data entry, document generation, and compliance checks. Electronic Document Management Systems (EDMS) reduce errors and time spent on filing and retrieval, providing secure, anytime access to files.

Beyond these, consider:

- Collaborative Tools – Platforms like Slack or Microsoft Teams facilitate real-time communication and keep team members aligned, reducing delays and preventing miscommunication.

- AI and Machine Learning – These technologies can automate document processing, fraud detection, and enhance risk assessments, leading to faster and more accurate decision-making.

- Automated Communication Tools – Implement automated updates for key stages of the loan process to keep borrowers informed and enhance their experience.

- Cloud-based Platforms – These solutions offer reliability, mobility, and scalability, reducing IT costs and enabling dynamic workflows for credit risk management across the enterprise.

- Credit Software Platforms – Digital solutions can automate the entire credit management process, offering online credit applications, customizable scoring engines, and data aggregation from credit agencies. To learn more, see how AI and real-time data are revolutionizing credit risk management to support such digital transformation initiatives.

5. Staff Productivity Optimization

An optimized workflow directly translates to increased staff productivity and satisfaction. By removing unnecessary steps and automating repetitive tasks, teams can achieve more in less time, reducing frustration and burnout. It also allows human capital to be reallocated to more strategic, value-driven activities, leveraging their intelligence and creativity.

To further boost productivity:

- Cross-functional Collaboration – Break down departmental silos to enable seamless data sharing, preventing duplicate efforts and ensuring everyone is informed.

- Employee Training and Empowerment – Encourage employee input for process improvement, as those closest to the process often have the most valuable insights. Provide the necessary skill development to ensure they can effectively follow improved processes.

- Clear Goals – Ensure team members are aligned with objectives and understand the direction of efforts, which helps them work efficiently towards eliminating bottlenecks. See the top ways data analytics supports productivity and performance in this blog on use cases in commercial lending.

6. Quality Control Integration and Standardization

Delivering high-quality outcomes with low error rates is a primary goal of workflow optimization. This is achieved by putting consistent processes in place and automating them where possible. Standardizing your workflow processes ensures a uniform approach regardless of who performs the task or when.

Standardization means setting a “gold standard” for operations, producing reliable results and eliminating variables that hinder optimal output. This consistency maintains high quality and efficiency, repeatedly offering a reliable customer experience and building brand reputation and trust. For example, in credit management, standardized credit scoring rules and e-signatures simplify the application process for both creditors and customers, improving efficiency and compliance.

7. Measurement and Monitoring Systems

Workflow optimization is an ongoing commitment; the work doesn’t stop after initial revamp. To ensure continuous efficiency and relevance, you must regularly monitor existing workflows and solicit feedback.

Key Performance Indicators (KPIs) are crucial for measuring the results of your optimization efforts. Some relevant KPIs include:

- Task Completion Time – Measures the average time to complete a specific task or process.

- Error Rate – Calculates the percentage of tasks containing errors or requiring rework.

- Customer Satisfaction Score (CSAT) – Directly measures customer satisfaction with a process.

- Employee Productivity Rate – Gauges the average output of an employee.

- Cost Per Transaction – Monitors the average cost associated with each business transaction.

Quantitative KPIs are preferred for setting clear expectations and ensuring accountability. Continuously engaging with team members, assessing metrics, and observing performance will help identify areas for incremental improvements, leading to “optimally optimized” workflows over time. The optimization journey is never truly complete; it evolves with each feedback loop. Learn how modernizing your credit portfolio management can support ongoing measurement and monitoring for long-term impact.

Conclusion

In the modern business landscape, staying static is not an option. Optimizing your credit operations workflows is indispensable for efficiency, productivity, and sustainable growth. By embracing strategic assessments, leveraging advanced automation, fostering collaboration, and committing to continuous improvement, your business can significantly reduce costs, enhance quality, mitigate risks, and most importantly, deliver an exceptional experience for your customers and employees alike. It’s about making your work work better, driving your business forward in an ever-evolving market. To see how leading institutions are modernizing loan processes, check out our blog on improving commercial loan origination efficiency with automation.

At Anaptyss, we specialize in transforming credit operations for financial institutions through intelligent workflow design, advanced automation, and domain-driven digital services. Whether you’re looking to reduce operational friction, enhance decision accuracy, or deliver a better borrower experience, our team can help you build scalable, future-ready credit processes.

Ready to optimize your credit workflows?

Reach out to us at info@anaptyss.com to start the conversation.

At Anaptyss, we specialize in transforming credit operations for financial institutions through intelligent workflow design, advanced automation, and domain-driven digital services. Whether you’re looking to reduce operational friction, enhance decision accuracy, or deliver a better borrower experience, our team can help you build scalable, future-ready credit processes.

Ready to optimize your credit workflows?

Reach out to us at info@anaptyss.com to start the conversation.