In this blog, we will explore the key regulatory challenges in the financial sector and the key areas where RegTech solutions are applied to simplify the compliance process for banks and financial institutions.

RegTech or Regulatory Technology refers to technology that helps financial institutions manage their regulatory and compliance requirements efficiently and cost-effectively.

RegTech solutions automate and streamline compliance processes, allowing financial institutions to address the complexities due to the increasing data and evolving regulations. This helps them reduce costs and minimize the risks associated with compliance expenses and penalties due to regulatory violations.

5 Key Regulatory Challenges in the Financial Services Industry

Below, we have listed five primary compliance challenges banks and financial institutions face while addressing compliance requirements.

1. Cross-Border Compliance Complexities

Many banks and financial institutions operate in different jurisdictions and need to ensure that they comply with the local laws, regulations, and standards. However, meeting cross-border compliance can be a challenging task due to:

- Differences in legal and regulatory frameworks

- Language and cultural differences

- Business practices

- Data privacy and security requirements

- Supply chain complexity

2. Transaction Monitoring and Reporting Accuracy

Violations or failure to adhere to the compliance requirements for transaction monitoring and reporting can have severe consequences.

However, ensuring accuracy and efficiency in transaction monitoring and reporting is a significant operational challenge due to the sheer volume of transactions that are often overwhelming and may result in significant false positives. This can further increase the workload for manual reviews and lead to operational challenges.

3. Rising Cyber Attacks and Data Breaches

Banks and financial institutions hold sensitive, private, and confidential data, such as personally identifiable information (PII), making them a prime target for cyber-attacks. Ransomware or internal exploits can jeopardize the banks’ or financial institutions’ compliance efforts and potentially cripple the businesses.

While regulators have responded and introduced new regulatory standards, technologies, and guidance, many financial institutions and firms often struggle to implement these security programs, frameworks, internal controls, and policies effectively due to a lack of expertise.

4. Integration of Fintech

Technology has undeniably enhanced speed, performance, and reliability across industries, including financial services. However, the integration of financial technologies (also termed FinTech) has compounded the intricacies of compliance.

Fintech solutions, including mobile e-commerce, digital currencies, and web-based tools have introduced new compliance risks, regulatory uncertainty, and challenges concerned with data security, privacy, and cross-border compliance.

5. Rising Compliance Costs

When considering “costs” in a regulatory context, the immediate association is often with the consequences of non-compliance. However, compliance itself is a tangible financial investment, and the associated costs can be substantial.

According to LexisNexis Risk Solutions’ 2021 True Cost of Financial Crime Compliance Study, the estimated cost of financial crime compliance in Canada and the U.S. for 2021 was $49.9 billion. This was a 19% increase from 2020.

How RegTech Solutions Can Help Financial Institutions Meet Regulatory Compliance?

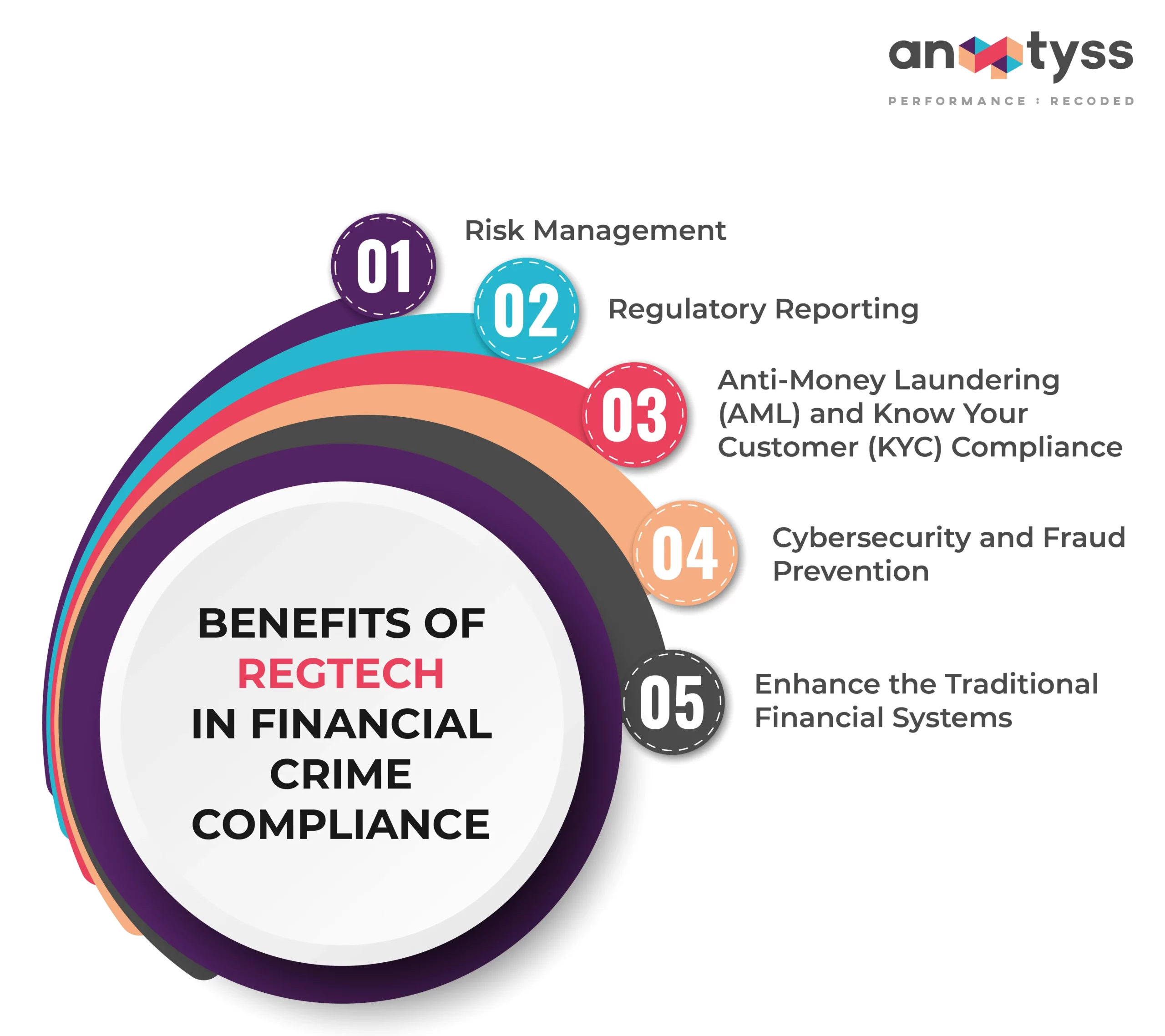

Following are the key areas where RegTech solutions are applied to efficiently meet and fulfill various compliance requirements.

1. Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

Banks and financial institutions can use next-gen AI-based KYC and AML screening solutions, such as Alfa™, to automate critical KYC/AML processes. These processes include customer due diligence, identity verification, watchlist screening, and transaction monitoring to detect and prevent money laundering, financing of terrorism, and other illicit activities.

2. Risk Management

With advanced analytics and monitoring solutions, banks and financial institutions can efficiently assess and manage various types of financial crimes and enterprise risks, including fraud, operational, credit, and market risks, to ensure compliance with regulatory requirements.

3. Regulatory Reporting

This includes implementing systems to collect, manage, and report data to regulatory authorities based on compliance reporting requirements, such as those related to financial transactions (SARs) or market activities.

4. Cybersecurity and Fraud Prevention

This includes the use of technology to enhance cybersecurity measures, detect and prevent fraudulent activities, and ensure compliance with data protection and privacy regulations, such as HMDA, PCI-DSS, SOX, and GDPR.

5. Enhance the Traditional Financial Systems

Use of blockchain to create transparent and immutable records. With smart contracts, banks can automatically execute, control, or document events based on predetermined conditions, enhancing the integrity of financial transactions and compliance processes.

34% of businesses say that RegTech solutions are influencing the management of compliance: Thomson Reuter’s Cost of Compliance Report 2021

Conclusion

Meeting regulatory requirements is complex and involves substantial costs and efforts. RegTech solutions, such as ALFA, can support banks and financial institutions with their compliance needs and help them navigate the complexities of a continuously evolving AML/KYC regulatory environment, market trends, and customer expectations.

To learn more about ALFA, contact us at info@anaptyss.com.