In today's digital-first world, financial crimes like money laundering and fraud are evolving with technology. Financial institutions face challenges in AML compliance due to manual processes, high compliance overheads, lack of real-time monitoring, limited traceability, and slow response times. This blog discusses how Blockchain technology can mitigate these challenges by enhancing transparency, improving KYC processes, facilitating real-time transaction monitoring, ensuring crypto AML compliance, boosting security, and reducing costs.

Financial crimes, such as money laundering, fraud, terrorist financing, etc., are serious crimes that are constantly evolving with the advancements in technology.

In today’s digital-first world, criminals always try to come up with more innovative and sophisticated ways to avoid the attention of the authorities. However, financial institutions, such as banks, are under constant pressure to facilitate safe and efficient transactions with their clients.

This blog discusses the AML compliance challenges in the digital age and how Blockchain technology is enabling financial institutions to effectively navigate the compliance landscape while ensuring superior customer experience (CX).

What is Blockchain?

Blockchain is a decentralized, distributed, and cryptographic ledger technology consisting of digital transaction records across multiple computers on a public or private network. The ledger is public and transparent which makes it difficult to alter the transactions.

The decentralized, immutable, and cryptographically secure nature of Blockchain technology helps in transparency for AML compliance. It also allows financial institutions and regulatory authorities to effectively monitor, identify, and stop suspicious activities or transactions.

5 Key AML Compliance Challenges in the Digital Age

Financial institutions face various challenges when it comes to keeping up with the AML compliance requirements with their traditional approach. The existing transaction monitoring systems are insufficient to analyze and track the high-volume transactions or meet their pace.

1. Manual Processes

Traditional AML solutions heavily rely on transaction monitoring and reporting processes. This manual approach could be inherently time-consuming and requires humans to review and analyze the financial transactions, which can lead to:

- A significant number of false positives

- Suspicious activities going undetected

- Incorrectly flagged transactions

2. Compliance Overhead

AML solutions are intricate and require meticulous integration into existing systems and processes. As a result, financial institutions need to hire the right talent and invest in specialized staff training, advanced technologies, and establish comprehensive monitoring and reporting mechanisms. However, this can increase the operational cost and require significant time and effort to ensure the AML controls align with the regulatory requirements.

3. Lack of Real-Time Monitoring

With limited oversight and the absence of real-time monitoring with traditional AML solutions, it is cumbersome for financial institutions and authorities to track and analyze the transactions. This leads to delays in response to potentially suspicious transactions. Involved in money laundering, terrorist financing, or other illicit activities.

4. Limited Traceability

When it comes to tracing and investigating suspicious transactions, traditional AML solutions provide limited traceability. This makes it difficult to track down the source of funds, especially when the transaction involves crypto assets or cryptocurrencies. This can be an obstruction for the compliance teams in their efforts to detect and prevent suspicious activities involving the risk of money laundering or terrorist financing.

5. Slow Response

Traditional or existing AML solutions are more reactive. They help in detecting suspicious activities once they occur rather than preventing them in the first place.

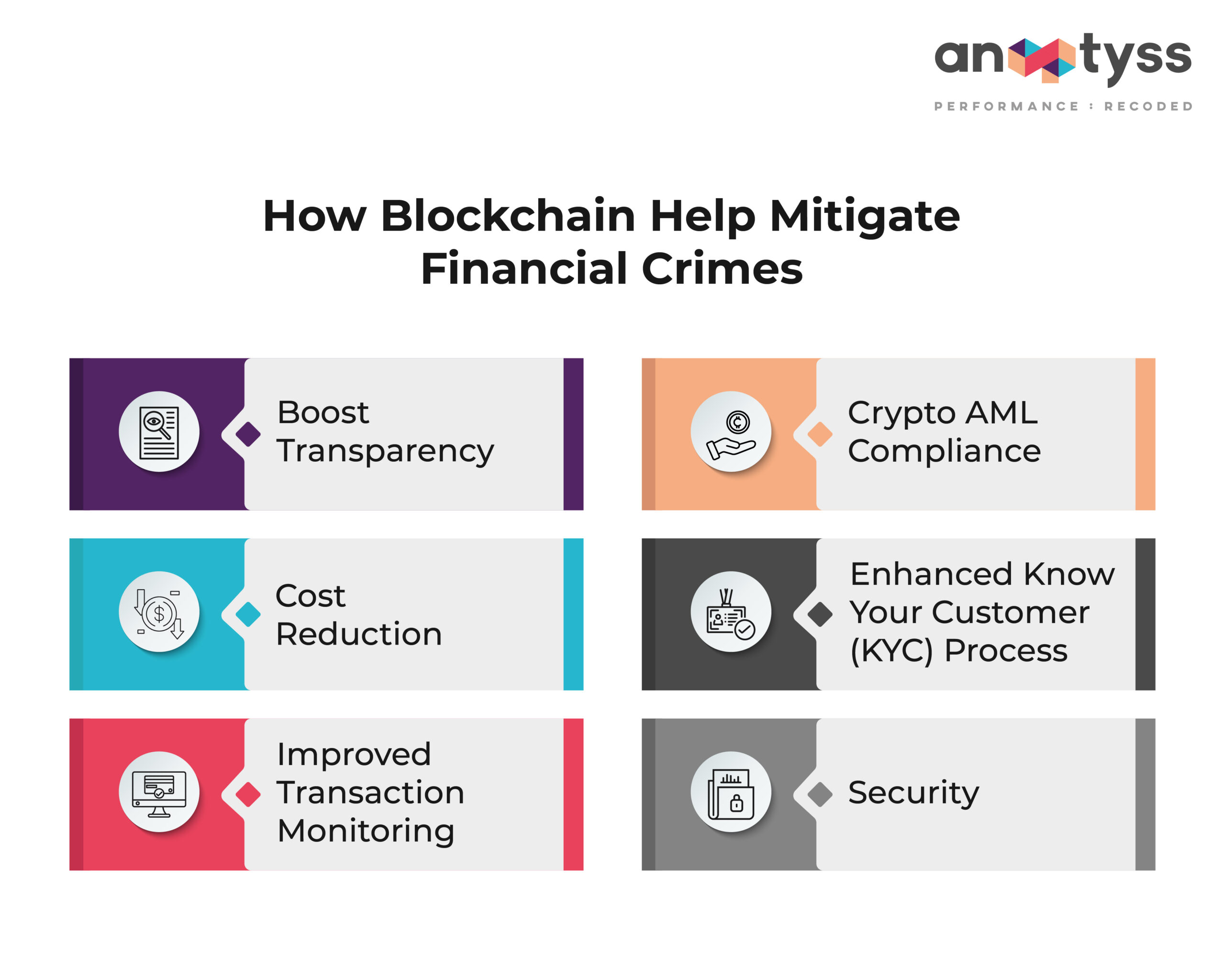

How Blockchain Help Mitigate Financial Crimes

In 2022, banks paid nearly USD 5 billion in AML fines globally – a 50% increase from the previous year.

Most of these financial institutions that were fined had failed to implement effective Know Your Customer (KYC) processes, which led to violations of AML regulations.

Below are some examples of how Blockchain technology helps financial institutions combat financial crime and ensure financial crime compliance.

1. Boost Transparency

Blockchain’s decentralized and distributed ledger technology enhances transparency by providing a single immutable record, shared among all participants. This means every transaction is recorded and visible on the network, which reduces the opacity linked with traditional systems.

As a result, it helps deter illicit activities and makes it more challenging for criminals to conceal, move, or manipulate transactions. This can further help financial institutions from reputational damage and showcase their commitment to preventing money laundering and other financial crimes.

2. Enhanced Know Your Customer (KYC) Process

Blockchain enables separate storage of client information, which is tamper-proof and immutable. The background information and identification stored on a blockchain network help streamline the Know Your Customer (KYC) process, making it easier, faster, more comprehensive, and secure against human error or internal fraud. Once the details are logged, they can’t be altered.

3. Improved Transaction Monitoring

Blockchain facilitates real-time transaction monitoring with its transparent and traceable nature. This feature allows financial institutions to monitor transactions more effectively and identify and investigate suspicious activities promptly. It can also reduce false positives and errors, which is a major pain when it comes to transaction monitoring.

For instance, financial institutions can utilize smart contracts as a tool to enforce AML compliance. Smart contracts are self-executing programs that are designed to automatically execute when predetermined terms and conditions are met. Smart contracts can help identify and flag potentially suspicious transactions for additional review if they exceed the threshold levels or are detected as high-risk.

4. Crypto AML Compliance

Cryptocurrency or Convertible Virtual Currencies (CVCs) are increasingly used for financial crimes, such as money laundering, and pose a significant threat to AML compliance efforts.

However, blockchain provides solutions to overcome the challenges of cryptocurrency compliance. Cryptocurrency operates on Blockchain technology to record and confirm trades. When cryptocurrency is bought, sold, or exchanged, a blockchain collects and records the transaction information.

By implementing the AML measures with the help of Blockchain smart contracts, financial institutions can enforce the compliance rules to ensure the transaction meets the regulatory requirements. This can help prevent money laundering and ensure crypto transactions meet the AML compliance criteria.

5. Security

Blockchain employs cryptographic technology to secure the transactions and protect them from potential risks of hack or fraud. The immutable records created by the blockchain ensure the added block to the chain can neither be altered nor removed. This helps minimize and mitigate the risk of financial crimes, such as fraud or unauthorized access. Also, it makes it nearly impossible for criminals to tamper with or erase evidence of illicit activities.

6. Cost Reduction

Blockchain helps streamline processes and reduce the requirements of intermediaries by automating the processes without manual intervention with the help of smart contracts. This can significantly reduce:

- Operational costs

- Expenses related to intermediaries

- High cost of AML transaction monitoring

- KYC processes

The auditable nature of blockchain further makes it easier for financial institutions, regulators, and auditors to efficiently trace transactions on the blockchain. This reduces the time and resources required for auditing and reporting.

Conclusion

Blockchain technology is still evolving and is in the early stages. However, it has the potential to help financial institutions overcome the challenges of traditional AML compliance solutions in today’s digital-first world and significantly reduce the risks of financial crimes.

To learn more, you can also read our guide to Anti-Money Laundering for financial institutions and AML compliance checklist to effectively combat and mitigate financial crimes, such as money laundering, terrorist financing, fraud, etc.

For more information, please connect with us at: info@anaptyss.com