Compliance

Reconciliation in Banking – Importance and New Challenges

Financial reconciliation is a fundamental process in accounting, which involves auditing a company's books or general ledger and tallying them...

AML Compliance

What is Customer Due Diligence and How Does It Work?

Customer Due Diligence (CDD) is a Know Your Customer (KYC) and Anti-Money Laundering (AML)/Countering Terrorism Financing (CTF) regulatory requirement for...

AML Compliance

What is Enhance Due Diligence (EDD) in Banking and Financial Services

At its core, Enhanced Due Diligence is a comprehensive set of KYC/AML procedures that banks and financial institutions follow to...

AML Compliance

Real-Time Payment Fraud Detection & AML Compliance: Expert Strategies for Banks

In the constantly changing world of banking, spot payment scams as they happen (frauds) and money laundering are issues that...

AML Compliance

Evolving AML Trends: How Global Sanctions and Regulations Impact Compliance Strategies

In recent years, the landscape of Anti-Money Laundering (AML) violations and fines has seen significant developments influenced by global sanctions,...

AML Compliance

How to Build a Robust Transaction Monitoring System for AML Compliance: Guide for Bankers

The banking industry continues to build robust AML compliance systems and practices amid growing financial crime threats and volatility. In...

AML Compliance

How to Build an Expert Compliance Team: A Guide for Banks

In today's rapidly evolving financial landscape and increasing regulatory requirements, banks and financial institutions face a significant challenge: managing complexity...

Compliance

Key Challenges in RegTech Adoption for Financial Institutions

Financial institutions bear substantial compliance costs, varying inversely with their size. However, failure to comply with the regulatory requirements also...

Compliance

How to Enhance Fraud Detection in Digital Payments – A Guide for Banks

The shift towards real-time or instant payments is becoming increasingly common worldwide. However, with new payment systems, such as digital...

AML Compliance

How to Improve the Sanctions Screening Process in Banking?

Sanctions screening plays a pivotal role for banks in the fight against financial crimes. It acts as a frontline defense...

AML Compliance

How Blockchain Can Help Banks Enhance AML Compliance?

Financial crimes, such as money laundering, fraud, terrorist financing, etc., are serious crimes that are constantly evolving with the advancements...

Compliance

Cybersecurity Laws, Regulations, and Standards for the Financial Services Industry

With the growing amount of personal and business data in the custody of financial institutions, they face unprecedented risks to...

AML Compliance

How to Conduct AML Risk Assessment: Types and Implementation

In the modernizing financial services landscape, the risks of financial crimes such as money laundering and terrorist financing have increased...

Compliance

How to Navigate Cross-Border AML Regulatory Compliance Challenges?

Financial institutions often encounter vast compliance challenges while operating in the domestic market. The regulatory challenges become even more complex...

Compliance

What is Transaction Laundering: A Growing Threat to AML Compliance

Transaction laundering is a process through which unknown entities use and process their payments through facilities provided by a merchant...

Compliance

Regulatory Technology (RegTech) for Compliance in the Financial Services Industry

RegTech or Regulatory Technology refers to technology that helps financial institutions manage their regulatory and compliance requirements efficiently and cost-effectively....

Compliance

The Challenges of Cryptocurrency Compliance – How Banks Can Overcome Them

Cryptocurrency is a digital or virtual currency that has revolutionized the financial services industry. Cryptocurrency offers both opportunities and poses...

Compliance

FATF Red Flags for Money Laundering and Terrorist Financing

Money laundering has been rising globally despite the growing laws and regulations and clamping down from enforcement agencies. The annual...

Compliance

Evolution of the Basel Accords: An Overview

The development of the Basel Accords continues to evolve. As a result, from 2012-2017, the commission dealt with questions about...

Compliance

FATF Plenary February 2023: Key Outcomes

The second Plenary of the Financial Action Task Force (FATF) led by Singapore president T. Raja Kumar recently concluded its...

Compliance

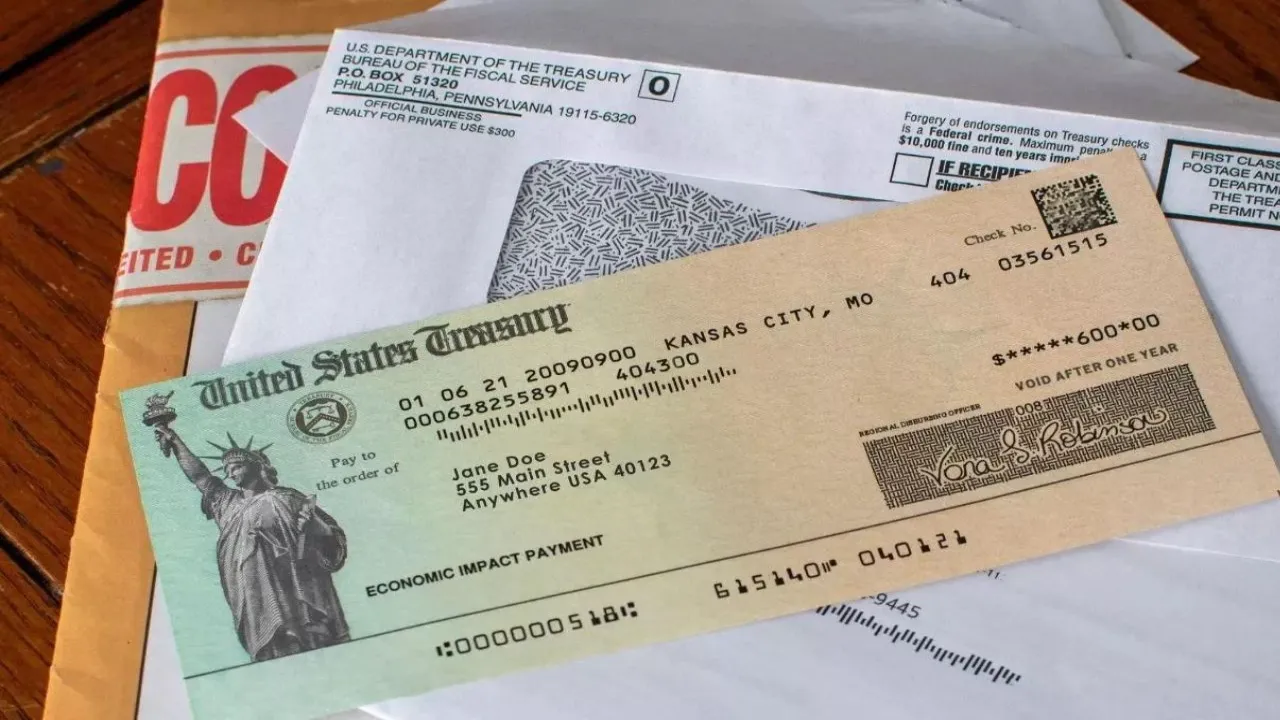

FinCEN Alert (FIN-2023-Alert003) on Mail Theft-Related Check Fraud Schemes

The Financial Crimes Enforcement Network (FinCEN) has issued a new nationwide alert—FIN-2023-Alert003—to banks and financial institutions on theft-related check fraud...

Compliance

What is Financial Crime Compliance (FCC)?

Financial Crime Compliance (FCC) is a process to ensure your bank or financial institution is meeting the policies, standards, and...

Compliance

FinCEN Strengthens the AML Whistleblower Program

The Financial Crimes Enforcement Network anti-money laundering whistleblower program was enacted on Jan 1, 2021. The program was created to...

Compliance

Basel Norms: Purpose and History

Basel Norms or Basel Accords are the international banking regulations issued by the Basel Committee on Banking Supervision - BCBS....

Compliance

Guide to Anti-Money Laundering in Banking and Finance

Anti-money laundering or AML in banking and finance refers to the legal obligations, set of rules, procedures, and regulations to...

Compliance

An Overview of the OFAC Sanctions and Program Types

Economic and trade sanctions are one of the ways the United States uses to deter and penalize human rights violations,...

Compliance

BSA/AML and Sanctions Program Framework: Key Imperatives for Banks

A robust BSA/AML and Sanctions Program framework is crucial for banks to attain compliance with heightened regulatory requirements. The rapidly...

Compliance

The High Costs of AML Transaction Monitoring: Can Machine Learning Help?

The Bank Secrecy Act (BSA) obligates financial institutions to follow a stringent transaction monitoring process to track/monitor, investigate, and report...

Compliance

Anti-Money Laundering Compliance – Checklist and Best Practices

Money Laundering is a persistent problem globally. As per UNODC, 2-5% of global GDP ($800 billion - $2 trillion) is...

Compliance

Russian Sanctions – Highlighting of Compliance Complexities

The invasion of Ukraine has resulted in a flurry of tough sanctions on Russia by the United States, the European...